Wealth management firms face mounting pressure to differentiate themselves in an increasingly competitive landscape where products and pricing have become commoditized. The quality of customer experience has emerged as a primary factor driving client retention, revenue growth, and long-term competitive advantage in wealth management. Clients now expect the same level of personalized, seamless digital interaction they receive from leading technology companies.

The relationship between customer experience and business outcomes is measurable and significant. Firms that deliver superior experiences retain more assets under management, generate higher referral rates, and command premium fees. Digital experience satisfaction drives investor loyalty, with top-performing brands setting themselves apart through intuitive design and consistent cross-channel engagement.

Understanding what constitutes exceptional customer experience requires examining both the strategic importance and practical implementation. This article explores why CX matters, how it connects to financial performance, what today's best practices look like, and how firms can leverage advanced tools to deliver personalized experiences at scale.

Why Wealth Management Customer Experience Matters More Than Ever

Wealth management firms face unprecedented pressure to deliver exceptional experiences as client expectations evolve rapidly and competitive advantages increasingly hinge on relationship quality rather than product offerings alone.

Expectations Are Rising Across All Financial Services

Affluent investors now demand seamless, personalized experiences that blend human expertise with digital capabilities. These clients interact with technology companies and service providers daily that set new standards for responsiveness and customization.

High-net-worth individuals expect 24/7 access to their portfolios from any location. They want immediate responses to queries and real-time updates on their investments. The bar continues to rise as consumer-facing companies in other sectors refine their customer experience strategies.

Customer-focused businesses are 60% more profitable than those that do not prioritize client needs. Superior customer experience leads to 5.7 times higher revenue on average. These metrics demonstrate that meeting elevated expectations directly impacts firm performance.

Relationship-Driven Industries Feel CX Impact Faster

Wealth management operates on trust and long-term relationships, making it particularly vulnerable to experience failures. A single negative interaction can erode years of relationship-building work.

Client loyalty correlates directly with experience quality. Clients receiving excellent experiences show 94% likelihood to recommend services compared to just 13% for those with very poor experiences. Trust levels follow similar patterns, with 89% of clients trusting firms that deliver excellent experiences versus 16% for very poor ones.

Satisfied clients generate referral traffic that brings new business without additional marketing costs. They also tend to consolidate more assets with firms they trust, increasing wallet share. The relationship-driven nature of wealth management amplifies both positive and negative experience outcomes across the entire client lifecycle.

The Direct Link Between CX, Retention, And Revenue Growth

Wealth management firms that prioritize customer experience see measurable improvements in client retention rates, referral generation, and overall wallet share. These three outcomes combine to create sustainable revenue growth that outpaces competitors.

Strong CX Directly Improves Retention

Client retention in wealth management depends heavily on the quality of ongoing experiences rather than purely on investment performance. Research shows that customer-focused businesses are 60% more profitable than those that neglect client experience priorities.

The retention impact becomes clear when examining client behavior across different CX quality levels. Clients who receive excellent customer experience show 77% willingness to forgive mistakes, compared to just 15% among those receiving very poor experiences. This forgiveness factor directly affects retention during market downturns or operational challenges.

Even a 5% increase in customer retention can boost profitability by as much as 95%, as returning clients typically require less marketing investment while spending more over time. Wealth managers who implement personalized communication, efficient service delivery, and 24/7 portfolio access create experiences that keep clients engaged through various market conditions.

CX Drives More Referrals Than Performance Alone

Word-of-mouth recommendations carry substantial weight in wealth management, where trust forms the foundation of client relationships. Clients who experience excellent customer service demonstrate 94% likelihood to recommend their wealth manager, while those receiving merely adequate service drop to 66% recommendation rates.

This referral gap translates directly into client acquisition costs. Businesses that prioritize CX grow revenue faster by turning satisfied clients into brand advocates who actively promote services to peers. High-net-worth individuals particularly value peer recommendations when selecting wealth management partners.

The compounding effect of referrals becomes significant over time. Each positive client experience potentially generates multiple new relationships without additional marketing expenditure, creating an organic growth channel that competitors struggle to replicate through advertising alone.

CX Strengthens Share Of Wallet

Superior customer experience encourages clients to consolidate more assets with their primary wealth manager rather than diversifying across multiple firms. Studies indicate that customers spend 140% more on brands that deliver good customer experiences, demonstrating the direct revenue impact of CX investment.

Wealth managers who provide seamless portfolio consolidation, integrated team communication, and personalized reporting make it easier for clients to transfer additional assets. This convenience factor reduces friction in the decision-making process. Clients who trust their advisor's responsiveness and transparency feel more comfortable allocating larger portions of their wealth to that relationship.

The financial impact extends beyond initial asset transfers. Superior customer experience leads to an average of 5.7 times higher revenue compared to firms with weaker CX strategies. Cross-selling opportunities also increase as satisfied clients become more receptive to additional services like estate planning, tax optimization, and family office capabilities.

What "Great" Wealth Management Customer Experience Looks Like Today

Today's exceptional wealth management experience centers on understanding individual client psychology, providing fluid access across all platforms, and maintaining clear dialogue throughout the relationship. Firms that excel in these areas build stronger client loyalty and deeper trust.

Personalization Based On True Client Psychology

Great wealth management goes beyond basic demographic segmentation to understand how individual clients actually think about money and risk. Advisors who excel recognize that some clients prioritize wealth preservation while others focus on growth, and these preferences stem from personal experiences and psychological factors rather than age or income alone.

Leading firms analyze behavioral patterns and motivations to anticipate client needs before they're expressed. They track communication preferences, risk tolerance shifts during market volatility, and life events that trigger financial planning needs. This approach differs from simple product recommendations based on net worth brackets.

The best personalization in financial services acknowledges gender differences in investment approaches and communication styles. Women investors often prefer collaborative decision-making and detailed explanations, while some clients want concise recommendations. Important to remember: These preferences are not just female-centric; there are many male investors who prefer this same approach. The key is understanding the psychology of each client.Advisors adapt their presentation style, meeting cadence, and portfolio reporting formats to match each client's actual preferences rather than assumed ones.

Technology enables this depth of personalization at scale. Client relationship management systems now capture granular preference data, while AI-driven insights help advisors prepare for meetings with context-specific talking points.

Seamless Omnichannel Interactions

Clients expect to switch between digital platforms, phone calls, and in-person meetings without repeating information or losing context. A seamless experience means starting a portfolio review on a mobile app during lunch and finishing it with an advisor via video call that evening.

The best firms maintain unified client profiles across all touchpoints. When a client messages through a secure portal at midnight, the advisor sees that history during their morning call. Document sharing works bidirectionally—clients upload tax forms through an app while advisors send proposals that clients can e-sign immediately.

Key omnichannel capabilities include:

- Consistent account views across mobile, web, and advisor platforms

- Real-time portfolio updates regardless of access point

- Integrated messaging that preserves conversation history

- Appointment scheduling synced with advisor calendars

- Biometric authentication for secure mobile access

This integration eliminates friction. Clients don't navigate separate logins for viewing accounts, accessing documents, or communicating with their team.

Transparent, Timely Communication

Outstanding wealth managers proactively communicate during market turbulence rather than waiting for panicked client calls. They explain fee structures in plain language and disclose potential conflicts of interest without prompting. This transparency builds confidence even when portfolio values decline.

Effective communication patterns include:

|

Communication Type |

Timing |

Purpose |

|

Market updates |

During significant volatility |

Context and reassurance |

|

Portfolio reviews |

Quarterly |

Performance assessment |

|

Strategy adjustments |

When triggers hit |

Proactive rebalancing |

|

Fee breakdowns |

Annually |

Cost transparency |

Great advisors tailor their communication frequency to client preferences. Some clients want monthly check-ins while others prefer quarterly contact unless action is required. The key is establishing these expectations upfront and honoring them consistently.

Timeliness matters as much as frequency. Returning calls within four hours and emails within 24 hours demonstrates respect for client concerns. When complex questions require research, advisors acknowledge receipt immediately and provide a timeline for the complete response.

Operationalizing CX As A Competitive Advantage

Wealth management firms must move beyond CX strategy documents and embed customer experience into daily operations through data infrastructure, advisor capabilities, and continuous measurement systems. Operationalizing customer experience requires organizational strategies that transform how firms collect information, train teams, and track performance.

Build A Unified Client Data Foundation

A fragmented data environment prevents advisors from understanding client needs and delivering personalized service. Wealth management firms typically operate with information scattered across portfolio management systems, CRM platforms, and third-party applications.

Establishing a single source of truth through consolidated data architecture eliminates duplicate records and enables seamless data transfer between systems. This foundation requires a canonical structure aligned to business taxonomy and supported by cloud-based infrastructure.

The unified approach delivers specific operational benefits:

- Advisors access complete client histories without switching between platforms

- Real-time insights enable proactive service rather than reactive responses

- Alternative data sources integrate smoothly for enhanced client analytics

- Compliance teams maintain accurate audit trails across all interactions

Firms must implement strong governance policies and security procedures as data capabilities expand. The golden record system supports efficient client-servicing workflows that span multiple products without creating system dependencies.

Train Advisors To Deliver Personalization At Scale

Technology infrastructure alone cannot transform customer experience without advisor skills to leverage these tools effectively. Wealth management professionals need training on digital platforms, data interpretation, and communication techniques suited to different client segments.

Advisors should learn to analyze consolidated client data quickly and translate insights into tailored recommendations. Training programs must cover how to use AI-powered tools for customer segmentation and behavior analysis.

Firms can deploy digital assistants that handle routine inquiries about account opening procedures and market outlooks. This technology frees advisors to focus on complex financial planning and relationship building. The key is teaching advisors when to use automation versus when personal attention adds the most value.

Measure, Monitor, And Optimize CX

Competitive advantage through customer experience emerges from continuous improvement and customer feedback, not one-time initiatives. Wealth management firms need specific metrics tied to business outcomes rather than vanity numbers.

Critical measurement areas include client retention rates, advisor productivity metrics, and time-to-resolution for service requests. Firms should track how clients interact with digital tools and where friction points occur in onboarding or portfolio reviews.

Regular client listening sessions reveal gaps between intended and actual experience. Survey data must connect to operational changes with clear ownership and deadlines. Analytics should identify which CX improvements correlate with increased client lifetime value and referral rates.

How Psychographic AI Unlocks Differentiated CX

Psychographic AI analyzes client personalities, values, and behavioral patterns to create tailored engagement strategies that go beyond traditional demographic segmentation. This technology enables wealth managers to anticipate client needs and communicate in ways that resonate with individual decision-making styles.

Understanding Motivators Turns CX Into Growth

Psychographic AI identifies what drives each client's financial decisions by analyzing communication patterns, risk tolerance indicators, and value preferences. A client motivated by legacy building requires different messaging and product recommendations than one focused on lifestyle enhancement or wealth preservation.

AI-driven wealth management systems map these motivational profiles to specific touchpoints across the client journey. When advisors understand whether a client values security, achievement, or independence, they can frame investment opportunities in language that connects with those core values.

The technology tracks behavioral signals such as response times to different communication types, engagement with specific content categories, and decision-making timelines. This data reveals patterns that human observation alone might miss, allowing firms to segment clients by psychological drivers rather than just asset levels or age brackets.

Predictive Insights Boost Advisor Effectiveness

Psychographic models predict which clients are likely to seek additional services, refer others, or disengage based on behavioral and attitudinal signals. Advisors receive alerts when a client's interaction patterns suggest dissatisfaction or readiness for portfolio expansion before these moments become visible through traditional metrics.

These systems analyze thousands of data points to forecast client needs three to six months in advance. An advisor might learn that a client with specific psychographic traits typically explores estate planning after certain life events or communication patterns emerge.

Customer-centric AI in wealth management prioritizes individual preferences to enhance service delivery. The technology recommends optimal contact timing, preferred communication channels, and relevant topics for each conversation based on the client's psychological profile and current life stage.

Psympl has developed a financial psychographic model for wealth management and financial services to leverage in client engagement, education, and marketing. It enables financial advisors to anticipate individual client needs and interact with them using persuasive messaging and communication techniques that speak directly to clients’ motivations, priorities, and “financial personalities.”

CX Is The Most Sustainable Differentiator In Wealth Management

The wealth management industry has reached an inflection point where customer experience has become the primary differentiator for gaining assets, onboarding clients, and retaining relationships. Firms that embed exceptional CX into their organizational DNA will capture market share from competitors still relying on traditional product-focused approaches.

Firms That Prioritize CX Will Win The Next Decade

According to research, 76% of wealth management executives identify improving customer experience as critical for business success. This recognition stems from changing client demographics and expectations.

Younger investors demand digital-first experiences with seamless omnichannel interactions. They expect real-time portfolio insights, AI-driven recommendations, and self-service capabilities without the friction of legacy systems. Firms that deliver these experiences benefit from improved customer loyalty, higher employee engagement, and stronger commercial performance.

A positive customer experience directly impacts Customer Lifetime Value, creating sustainable revenue streams over time. Wealth managers who transform their businesses around CX principles establish competitive advantages that products alone cannot replicate. The firms that act decisively on customer-centric strategies will define the industry standard for the next decade.

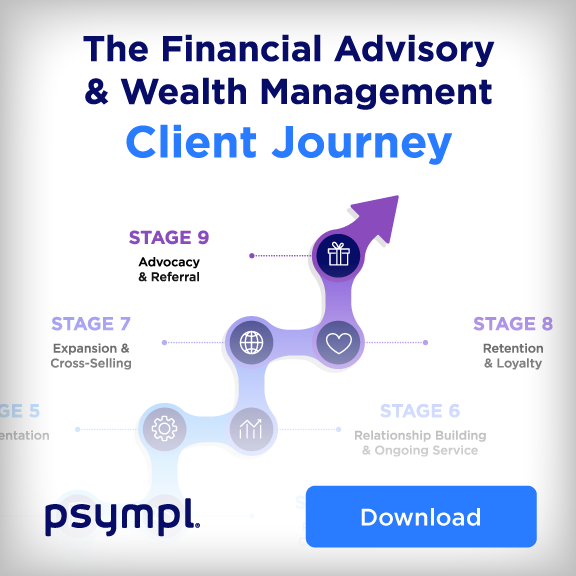

Download the Psympl Client Journey for Wealth Management

Deliver a wealth management customer experience that meets clients where they are.

Download Psympl’s Wealth Management Client Journey Infographic to understand motivations, emotional triggers, and decision patterns so your teams can personalize every touchpoint with confidence.

Brent Walker

Co-Founder & Chief Strategy Officer

.svg)