Modern banking customers expect to start a transaction on their mobile app, continue it at an ATM, and complete it with a phone call to customer service without missing a beat. Omnichannel banking integrates all customer touchpoints into a unified system that delivers consistent, personalized experiences across every interaction channel. This approach transforms disconnected banking services into a seamless customer journey.

Most financial institutions still operate with fragmented systems where mobile apps, websites, and branch locations function independently. Customers frequently encounter inconsistent information, repeated verification processes, and disjointed service experiences that erode trust and satisfaction. These gaps create friction that drives customers toward competitors who offer more integrated solutions.

The stakes extend beyond customer convenience to measurable business outcomes. Banks implementing comprehensive omnichannel strategies see significant improvements in customer retention, cross-selling opportunities, and operational efficiency. Understanding how to bridge the gap between fragmented customer experiences and truly unified banking services requires examining both the challenges institutions face and the strategic solutions that drive sustainable growth.

The Reality: Fragmented CX in Today's Financial Landscape

Banks face a stark disconnect between their customer experience ambitions and actual delivery. Research reveals a 56-point perception gap: 80% of business leaders believe they deliver great CX, while only 24% of customers agree.

This perception gap costs the industry billions. Poor customer experiences put $3.8 trillion in sales at risk for 2025, with U.S. businesses already losing $1.4 trillion annually due to CX failures.

Key fragmentation problems plague banking:

- Disconnected touchpoints force customers to repeat information across channels

- Inconsistent service quality between digital and branch experiences

- Limited personalization despite access to customer data

- Poor communication creates confusion about products and processes

Fragmented experiences frustrate customers as they navigate disjointed interactions across mobile apps, websites, branches, and call centers. Each channel often operates independently without shared context or seamless handoffs.

The root cause stems from organizational silos. Many banks still view customer experience as separate departmental functions rather than an integrated business approach. This fragmented structure prevents the cohesive experience that modern banking customers expect.

Technology infrastructure compounds these issues. Legacy systems struggle to integrate data and processes across channels, creating the technical barriers that prevent true omnichannel experiences.

The Modern Customer Expectation: Seamless, Personalized, and Predictive

Banking customers today demand instant, frictionless experiences across all touchpoints. Modern customers seek hyper-personalized interactions through apps, websites, and in-person visits without losing continuity.

Seamless Experience Requirements:

- Start transactions on mobile, complete on desktop

- Consistent information across all channels

- Zero repetition when switching platforms

- Real-time data synchronization

- Consistent experiences that reinforce the brand and personalize the customer journey

Nearly 70% of customers expect agents to have full context in every interaction. They want smooth transitions between channels without explaining their situation repeatedly.

Personalization has moved beyond basic customization. Banks must leverage behavioral and psychographic data to predict customer needs before they arise. Companies excelling at personalization generate 40% more revenue than average performers.

Key Personalization Elements:

- Transaction-based product recommendations

- Proactive financial alerts and insights

- Customized interface layouts

- Behavioral pattern recognition

- Psychographic insights on customer motivations and preferences

Predictive capabilities now define competitive advantage. Customers expect banks to anticipate life events, spending patterns, and financial needs. AI-driven personalization analyzes customer data to offer tailored recommendations and services automatically.

The shift represents a fundamental change from reactive to proactive banking relationships. Traditional one-size-fits-all approaches are becoming obsolete as customers demand individualized attention at scale.

Banks that fail to meet these expectations face significant customer churn and reduced competitive positioning in the digital marketplace.

Why Financial Institutions Struggle to Deliver True Omnichannel Banking

Most banks fail to achieve seamless omnichannel experiences due to outdated infrastructure, misaligned organizational structures, and inadequate technology integration. Traditional banking silos make it hard to deliver a smooth omnichannel banking experience while legacy systems prevent effective data sharing across channels.

Structural Challenges

Banks operate with departmental silos that create barriers between channels. Branch operations, digital teams, and customer service units often function independently with separate budgets and performance metrics.

This fragmentation leads to inconsistent customer experiences. A customer who starts a loan application online cannot easily continue the process in-branch without repeating information or facing delays.

Organizational resistance compounds the problem. Different departments protect their territories and resist integration efforts that might reduce their autonomy or budgets.

Legacy hierarchical structures make decision-making slow. Multiple approval layers prevent rapid response to customer needs across channels.

Key structural barriers include:

- Separate channel management teams

- Conflicting performance incentives

- Limited cross-departmental communication

- Rigid approval processes

Strategic Challenges

Many financial institutions lack unified customer experience strategies. They treat each channel as a separate business unit rather than components of an integrated system.

Inconsistent messaging across channels confuses customers. Product information, pricing, and promotional offers vary between mobile apps, websites, and branches.

Banks struggle with resource allocation decisions. They must balance investments in physical branches against digital platform development while maintaining profitability.

Customer data remains fragmented across different systems. Banks cannot create comprehensive customer profiles that inform personalized experiences across all touchpoints.

Strategic misalignment manifests through:

- Channel-specific rather than customer-centric goals

- Uncoordinated marketing campaigns

- Inconsistent service standards

- Separate customer databases

Technology Gap

Many financial institutions still can't effectively integrate disparate systems of record. Core banking systems built decades ago were not designed for real-time data sharing across multiple channels.

API limitations prevent seamless data flow between systems. Customer information updated in one channel may not appear in others for hours or days.

Legacy infrastructure creates technical debt that makes integration projects expensive and time-consuming. Banks face the choice between costly system replacements or complex workaround solutions.

Data security requirements add complexity to integration efforts. Banks must ensure customer information remains protected while enabling access across multiple platforms and devices.

Technical barriers include:

- Incompatible system architectures

- Limited real-time processing capabilities

- Complex data migration requirements

- Regulatory compliance constraints

The Solution: Building a Unified Omnichannel Strategy

Banks must integrate all customer touchpoints through centralized data systems, comprehensive journey mapping informed with psychographic insights, artificial intelligence insights, seamless channel connections, and continuous performance measurement. This strategic approach eliminates silos and creates consistent experiences across every interaction.

Step 1: Centralize Customer Data

Banks need unified data architecture that consolidates customer information from all channels into a single system. This eliminates data silos that create fragmented experiences.

Integrated data systems ensure customer information remains consistent across mobile apps, websites, ATMs, and branches. Real-time synchronization allows each touchpoint to access complete customer histories and preferences.

Key data integration requirements include:

- Customer profiles - Complete view of demographics, psychographics, preferences, and behavior

- Transaction history - Real-time account activity across all channels

- Interaction records - Service requests, complaints, and communication logs

- Product usage - Current services and engagement patterns

Banks should implement APIs that connect legacy systems with modern platforms. This technical foundation enables staff to access current information during any customer interaction.

Data governance policies must ensure accuracy and compliance across all integrated systems. Regular data quality audits prevent inconsistencies that damage customer trust.

Step 2: Map the Full Customer Journey

Understanding how customers move between channels reveals critical touchpoints where experiences break down. Journey mapping identifies these friction points and optimization opportunities.

Banks should document each customer interaction from initial awareness through ongoing service. This includes digital research, application processes, account management, and support requests.

Common journey stages can include:

|

Stage |

Primary Channels |

Key Actions |

|

Research |

Website, social media |

Product comparison, rate checking |

|

Application |

Mobile app, branch |

Account opening, document submission |

|

Onboarding |

Email, phone, digital |

Identity verification, initial setup |

|

Daily banking |

Mobile, ATM, online |

Transactions, balance checks |

|

Support |

Phone, chat, branch |

Problem resolution, guidance |

Journey maps should highlight where customers switch channels and why. More than half of customers use three to five channels during each banking interaction.

Banks must identify pain points like repeated information requests or inconsistent policies between channels. These gaps create customer frustration and abandonment.

Step 3: Use AI-Driven Insights

Artificial intelligence transforms raw customer data into actionable insights that personalize experiences and predict needs. AI enables banks to deliver relevant services at optimal moments.

Machine learning algorithms analyze customer behavior patterns across all channels. This analysis identifies preferences, predicts future needs, and flags potential issues before they escalate. Psychographic AI creates marketing and education content that resonates with each customer’s intrinsic motivations, persuading desired behavior activation.

AI applications in omnichannel banking:

- Predictive analytics - Anticipate customer needs and product interest

- Personalization engines - Customize offers and content by individual

- Chatbots and virtual assistants - Provide instant support across channels

- Fraud detection - Monitor transactions in real-time for suspicious activity

Advanced analytics help banks improve campaign conversion rates by integrating real-time behavioral data with traditional customer profiles. Some institutions report nearly tripled conversion rates.

AI-powered recommendation systems suggest relevant products based on life events, spending patterns, and financial goals. This proactive approach builds stronger customer relationships.

Step 4: Connect Digital and Human Channels

Seamless integration between automated digital services and human-assisted channels creates comprehensive support options. Customers should transition smoothly between self-service and personal assistance.

Modern branches evolve into advisory centers equipped with digital tools. Staff access complete customer profiles during in-person meetings, continuing conversations started online or through mobile apps.

Digital-human integration strategies:

- Video banking - Remote consultations with relationship managers

- Screen sharing - Digital assistance during complex transactions

- Warm transfers - Move conversations between channels with full context

- Callback scheduling - Queue management across phone and digital channels

Mobile apps should include options to connect with human advisors when needed. Chat functions can escalate to voice or video calls without losing conversation history.

Branch staff require training on omnichannel tools and customer context systems. They must understand how digital interactions inform in-person service delivery.

Step 5: Measure and Refine

Continuous measurement identifies successful omnichannel elements and areas needing improvement. Banks must track both operational metrics and customer satisfaction indicators.

Essential omnichannel metrics include:

- Channel switching frequency - How often customers move between touchpoints

- Task completion rates - Success rates for common banking activities

- Customer effort scores - Difficulty levels across different channels

- Net Promoter Score - Overall satisfaction and recommendation likelihood

- Cost per interaction - Efficiency of each channel type

Time to complete common tasks across channels reveals operational bottlenecks. Banks should benchmark these completion times regularly.

Customer feedback collection must occur across all touchpoints. Exit surveys, app ratings, and branch feedback provide comprehensive satisfaction data.

Regular strategy reviews should incorporate metric trends and customer feedback. Banks must adjust channel priorities, technology investments, and staff training based on performance data.

Testing new features through pilot programs minimizes risk while gathering improvement insights. Successful pilots can then scale across the entire omnichannel ecosystem.

Psympl Insight: From Fragmentation to Fluidity

Traditional banking relies on demographic data and transaction history. This approach creates fragmented customer experiences across channels. Banks struggle to understand why customers make specific financial decisions.

Psympl introduces psychographic profiling into financial services. Their research with Ipsos reveals deeper consumer motivations and behavior patterns beyond standard analysis methods.

Psychographics examine:

- Customer attitudes and values

- Financial priorities

- Personality traits

- Decision-making motivations

Consumer psychology forms the foundation for Psympl's personalization approach. Banks can move from generic messaging to targeted communications based on psychological profiles.

The platform addresses key omnichannel barriers:

|

Challenge |

Psympl Solution |

|

Identity fragmentation |

Unified psychographic profiles |

|

Data silos |

Integrated behavioral insights |

|

Generic messaging |

Personalized engagement |

Banks using psychographic data can predict customer needs more accurately. They create consistent experiences across digital and physical touchpoints. This method reduces the disconnect between customer expectations and service delivery.

Real-time personalization becomes possible through AI-powered psychographic analysis. Banks can adapt their strategies based on psychological triggers rather than just transactional patterns.

Financial institutions gain deeper client insights for strategic decision-making. The transformation moves banking from reactive service to proactive engagement.

The Payoff: Why Omnichannel Banking Drives Growth

Banks implementing omnichannel strategies see measurable improvements in revenue generation and customer retention. The integrated approach creates competitive advantages that translate directly into business performance and customer satisfaction metrics.

Business Benefits

Omnichannel banking drives return on investment through multiple revenue streams and operational efficiencies. Banks report significant increases in cross-selling success when they deliver consistent experiences across all touchpoints.

Revenue Growth

- Cross-selling rates increase by 15-25% when customers receive personalized offers across multiple channels

- Product adoption accelerates through seamless application processes that span digital and physical touchpoints

- Customer lifetime value rises as engagement deepens across integrated platforms

Operational Efficiency Banks reduce operational costs through centralized campaign management and automated customer journeys. Staff productivity improves when customer data flows seamlessly between departments and channels.

Competitive Positioning Financial institutions gain advantages over fintech disruptors by matching digital-first experiences while maintaining traditional banking strengths. This dual capability becomes increasingly valuable as customer expectations rise.

Risk management improves through real-time fraud detection and instant alert systems. Compliance costs decrease when banks use unified platforms that maintain consistent regulatory standards across all channels.

Customer Benefits

Omnichannel banking enhances customer experience by eliminating friction points and providing consistent service quality. Customers experience reduced wait times and fewer repetitive interactions when switching between channels.

Convenience and Accessibility Customers complete transactions using their preferred channels without losing progress or repeating information. Mobile applications sync with branch visits, allowing seamless continuation of complex processes like loan applications.

Personalized Service Banks deliver relevant product recommendations based on comprehensive customer profiles. Transaction history, psychographic motivations, preferences, and behavioral patterns inform tailored offers across email, mobile apps, and in-person interactions.

Trust and Reliability Consistent branding and service quality across channels builds customer confidence. When customers receive the same level of expertise whether they visit branches, call support, or use digital platforms, trust increases measurably.

Response times improve significantly when customer service representatives access complete interaction histories. This comprehensive view enables faster problem resolution and reduces customer frustration during support interactions.

The Future of Omnichannel Finance Is Psychographic

The banking industry stands at a transformation point where customer behavior and preferences drive strategic decisions. Traditional demographic segmentation no longer captures the complexity of modern consumer financial needs.

Psychographic profiling examines customer attitudes, values, and lifestyle choices rather than basic age or income data. Financial institutions can now understand why customers make specific banking decisions across different channels.

Modern banking platforms collect data from multiple touchpoints:

- Mobile app usage patterns

- Branch visit frequencies

- Digital transaction preferences

- Communication channel choices

- Product engagement levels

Combined with psychographic insights, like those offered by Psympl, these data reveal deeper insights into customer motivations. A customer might prefer mobile banking for convenience while seeking in-person consultations for major financial decisions. Their psychographic profile shows both digital comfort and relationship value.

AI-powered personalization enables banks to adapt their omnichannel approach based on individual psychological drivers. Some customers prioritize security and stability, while others value innovation and speed.

Banks that master psychographic segmentation will deliver experiences that resonate with customer core values. They will anticipate needs before customers express them and present relevant services through preferred channels.

The future of omnichannel banking belongs to institutions that understand their customers' minds, not just their wallets. Psychographic intelligence transforms banking from transactional to transformational.

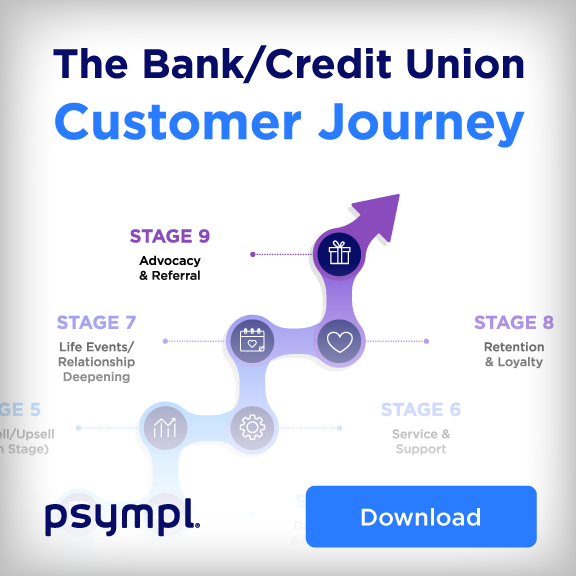

Ready to see how a connected experience really looks?

Download Psympl’s Customer Journey CX Infographic to visualize every stage of the financial customer journey and discover how omnichannel consistency drives engagement, trust, and loyalty.

Brent Walker

Co-Founder & Chief Strategy Officer

.svg)