In today’s rapidly evolving financial landscape, customer loyalty is no longer driven solely by product performance, interest rates, or convenience. The most successful financial institutions understand that behavior is emotional before it is logical. Traditional demographic and behavioral data only tell part of the story. Psychographics reveal the rest.

Psychographics go beyond “who” your customers are and “what” they do, uncovering why they make the financial decisions they do, because psychographics pertain to people's attitudes, values, lifestyles and personalities, which are core to their motivations. By leveraging psychographic insights, banks, credit unions, and financial service providers can move from transactional engagement to emotional connection by creating stickier customer relationships, higher conversion rates, and measurable growth.

Psympl, Inc. is pioneering this transformation, empowering financial institutions to see their customers more completely, engage them more effectively, and retain them more profitably.

The Shift: From Demographics to Psychographics

For decades, the financial services industry has relied on demographic and behavioral segmentation like age, income, account balance, and spending habits, to guide marketing and product strategies. But in an era of digital saturation, these data points no longer differentiate or predict intent.

Psychographics add a third, crucial dimension—revealing values, motivations, attitudes, and lifestyles.

|

Data Type |

Definition |

Example Use |

Limitation |

|---|---|---|---|

|

Demographic |

Who the customer is |

Age, gender, income |

Too broad; lacks emotional depth |

|

Behavioral |

What the customer does |

Purchase history, account usage |

Doesn’t explain why behavior happens |

|

Psychographic |

Why the customer behaves |

Beliefs, values, motivations |

Reveals emotional drivers for engagement |

When combined with traditional data, psychographics can create a holistic customer view enabling financial marketers to deliver precision-targeted experiences that resonate on a human level and persuade behaviors.

Why Psychographics Matter in Financial Services

Personalization at Scale

Psychographics enable hyper-personalized engagement content, offers, and experiences that feel tailor-made. Actual personalization, not lip service to the effort.

For example, two customers earning the same salary may make vastly different investment decisions based on their risk tolerance, life values, or trust in technology. Psychographic segmentation empowers institutions to communicate with both individuals uniquely, at scale.

Impact: Financial marketers using psychographic data have seen up to 40% increases in engagement rates and 25% lifts in conversion (Psympl internal data analysis, 2024).

Enhanced Customer Retention

Loyalty is emotional. Customers stay with financial brands that “get them.” By understanding motivations such as security, freedom, family, status, institutions can align messaging and product offerings to reinforce these emotional anchors.

Result: Up to 30% improvement in customer retention when psychographic insights guide relationship management strategies.

Predictive Customer Behavior

Psychographic modeling identifies emotional and attitudinal signals that precede financial actions, like switching banks, applying for a mortgage, or increasing savings.

Financial institutions using psychographic prediction can anticipate needs earlier and intervene proactively.

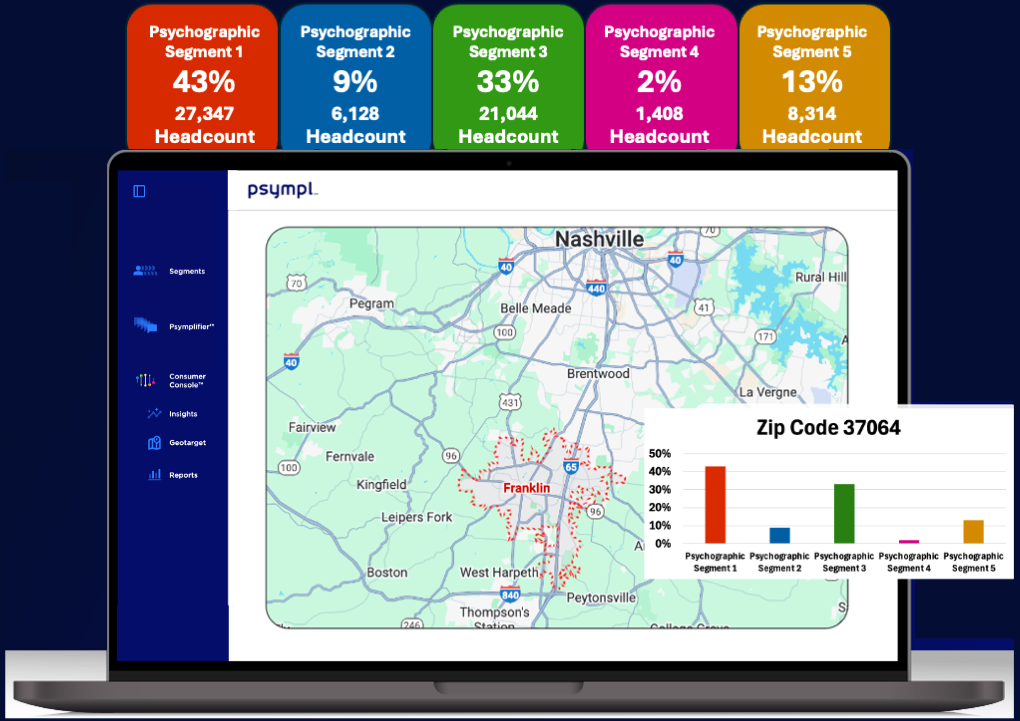

Competitive Differentiation and Understanding Where The Customers Are

In a market where products are increasingly commoditized, how a financial institution communicates becomes the differentiator. In addition to informing voice, tone, and message framing and turning generic campaigns into resonant brand experiences it is important to understand where your target customers can be found. Understanding the psychographic breakdown of the markets you would like to grow is vital to success.

Use Cases Across the Financial Services Ecosystem

|

Market |

Psychographic Application |

Measurable Outcome |

|---|---|---|

|

Retail Banking |

Segmenting by financial confidence and lifestyle priorities |

Higher cross-sell and up-sell rates |

|

Wealth Management |

Understanding risk attitudes and trust profiles |

Increased client satisfaction and referrals |

|

Insurance |

Tailoring offers to risk-averse vs. risk-tolerant consumers |

Improved policy adoption rates |

|

Credit Unions |

Aligning communication with community and purpose-driven values |

Deeper member engagement and retention |

|

Fintech |

Matching product design to digital comfort levels and openness to AI |

Faster adoption and higher application engagement |

How Psympl, Inc. Helps

Psympl, Inc. transforms psychographic intelligence into action through a proprietary data and engagement platform that helps financial institutions:

- Identify key psychographic segments within customer and prospect bases and where they are located

- Predict financial intent using psychographic and behavioral fusion models

- Personalize and Persuade marketing and content with messaging matched to audience motivations

- Measure the Results of emotional and financial impact of engagement at every digital and human touchpoint (What contact method to customers prefer?)

Our platform integrates seamlessly with CRM and marketing automation systems, enabling data-driven psychographic activation, without disruption to existing workflows.

The Business Impact of Psychographic Insight

|

Metric |

Traditional Segmentation |

With Psychographics |

|---|---|---|

|

Customer Engagement |

Moderate |

+40% average increase |

|

Conversion Rates |

2–5% |

5–8% (up to 25% in key segments) |

|

Customer Lifetime Value |

Baseline |

+20–30% growth |

|

Churn Reduction |

Minimal |

Up to 30% reduction |

Psychographics turn financial institutions from data-driven to human-driven organizations.

Conclusion

Financial success today requires more than understanding what customers do, it requires understanding why they do it. Psychographics bring these insights to life, empowering financial institutions to connect authentically, anticipate needs, and deepen relationships.

Psympl, Inc. is leading this evolution by making psychographic intelligence accessible, actionable, and measurable for financial brands of every size.

The future of financial services is emotional.

The future is psychographics.

About Psympl, Inc.

Psympl, Inc. helps organizations understand their customers on a deeper level through advanced psychographic data and persuasive, personalized engagement tools using Psychographic AI. Our mission is to simplify how businesses connect with people, making marketing more human, relevant, and effective.

To learn more, download our whitepaper, Psychographics in Financial Services and Wealth Management.

Mike Schiller

Mike Schiller is a lead investor and Vice President of Business Development for Psympl®. He brings more than 25 years of sales and marketing experience in various information technology markets. Prior to Psympl, Mike was Executive Vice President of Sales (CRO) at PatientBond, Inc. (acquired by Upfront Healthcare in 2022), an industry leader with a patient engagement platform based on psychographic segmentation models that resulted in several awards for growth and world-class client NPS scores. Prior to that, Mike held leadership positions ranging from Vice President to CEO for companies like MedEvolve, Streamline Health, Allscripts, GE Healthcare, IDX Systems Corporation, and Caremark International. He is a proven executive who has built and led several Sales organizations that provided solutions and services in healthcare, resulting in significant growth and client loyalty.

.svg)