Wealth management firms are drowning in client data yet struggling to deliver truly personalized experiences. Traditional approaches to client segmentation rely heavily on demographics, wealth metrics, and transaction history, missing the deeper psychological drivers that influence financial decisions. Artificial intelligence is transforming wealth management by combining traditional client data with psychographic insights to create unprecedented levels of personalization and engagement.

The challenge extends beyond simply having access to information. Wealth managers process enormous volumes of client data daily, from investment preferences to risk tolerance assessments, yet many firms report difficulty translating this information into actionable strategies that resonate with individual clients. AI is revolutionizing wealth management by enabling firms to analyze patterns in client behavior and preferences at scale.

The solution lies in understanding not just what clients do with their money, but why they make specific financial decisions. By integrating psychological profiling with advanced analytics, wealth management firms can move beyond generic investment recommendations to deliver experiences that align with each client's values, motivations, and communication preferences. This approach addresses the fundamental disconnect between data abundance and meaningful client engagement that has plagued the industry.

The Data Dilemma in Modern Wealth Management

Wealth management firms face an unprecedented challenge with data volume and complexity. Traditional systems struggle to process the massive amounts of information generated daily across multiple investment channels and client touchpoints.

Data Quality Issues plague many organizations. Inconsistent formats, duplicate records, and incomplete client profiles create barriers to effective analysis. These problems multiply when firms merge legacy systems with modern platforms.

The integration challenge extends beyond technical limitations. AI enables banks to analyse large amounts of data but requires clean, structured information to function effectively.

Key Data Challenges:

- Siloed information across departments

- Real-time processing limitations

- Regulatory compliance requirements

- Privacy and security concerns

Client expectations compound these difficulties. Younger investors demand personalized experiences based on comprehensive data analysis. They expect advisors to understand their complete financial picture instantly.

Data access remains a critical barrier. Private market information, alternative investments, and real-time market data often exist in separate systems. This fragmentation prevents wealth managers from delivering holistic advice.

Regulatory requirements add another layer of complexity. Firms must maintain detailed records while ensuring data protection compliance across multiple jurisdictions. The cost of managing these requirements continues to rise.

The storage versus insight problem represents the core dilemma. Firms collect vast amounts of information but struggle to transform it into actionable intelligence. Purpose-built AI is critical for guiding investors to make timely decisions, but only when supported by quality data infrastructure.

From Information Overload to Intelligent Insights

Wealth managers face an unprecedented challenge in today's data-rich environment. Market information streams constantly from multiple sources, creating cognitive bottlenecks that can delay critical investment decisions.

Traditional data analysis methods struggle to keep pace with real-time market movements. Financial advisors often spend hours sifting through reports, news feeds, and market data without extracting actionable intelligence.

AI transforms raw data into strategic advantages:

- Real-time processing of market information across global exchanges

- Pattern recognition in complex financial datasets

- Risk assessment through predictive analytics

- Client behavior analysis for personalized strategies

Advanced AI systems now analyze real-time capital market information and generate immediate insights that reduce barriers for new investors.

Modern AI platforms consolidate information from diverse sources into coherent investment narratives. They identify correlations between geopolitical events, economic indicators, and portfolio performance that human analysts might miss.

The technology enables wealth managers to respond quickly to market volatility. AI-driven insights help advisors make informed decisions during periods of uncertainty, particularly when geopolitical tensions and climate change contribute to market instability.

Key benefits include:

|

Function |

Traditional Method |

AI-Enhanced Method |

|

Data Analysis |

Hours of manual review |

Minutes of automated processing |

|

Market Monitoring |

Periodic updates |

Continuous real-time tracking |

|

Pattern Detection |

Limited human capacity |

Comprehensive algorithmic analysis |

Purpose-built AI systems provide sophisticated reporting and advanced data analytics that transform how wealth managers interpret market conditions and client needs.

The Missing Piece: Understanding Motivation Through Psychographics

Traditional demographic data provides limited insight into client behavior and preferences in wealth management. Psychographic profiling offers fresh perspective on consumer behavior beyond conventional demographic factors by examining the underlying motivations that drive financial decisions.

What Are Psychographics?

Psychographics pertain to people's attitudes, values, priorities and personalities, representing the core drivers behind their motivations, behaviors and communication preferences. Unlike demographics and socioeconomics, which describe who someone is, psychographics reveal why they make specific choices.

In wealth management, psychographic data captures clients' risk tolerance attitudes, wealth preservation values, and investment philosophies. These insights extend beyond age, income, or location to examine emotional drivers like security needs or growth aspirations.

Financial advisors can identify whether clients prioritize legacy building, lifestyle maintenance, or wealth accumulation. Each motivation requires different communication approaches and investment strategies.

Key psychographic factors include:

- Risk perception and tolerance levels

- Financial goal priorities

- Decision-making styles

- Trust and relationship preferences

- Communication channel preferences

Why Demographics Alone Aren't Enough

Demographics provide surface-level information but fail to explain behavioral differences within similar groups. Two 55-year-old executives earning identical salaries may have completely different investment approaches based on their psychological profiles.

Traditional demographic and socioeconomic factors miss what truly drives financial decisions. One executive might prioritize aggressive growth strategies while another focuses on capital preservation despite identical financial circumstances.

Generational assumptions often prove inaccurate when applied broadly. Millennials do not uniformly have a stronger risk appetite, and baby boomers don't universally prefer conservative investments.

Demographic/Socioeconomic limitations:

- Assumes uniform motivations and behavior within groups

- Ignores individual value systems

- Overlooks emotional decision factors

- Misses communication preferences

- Creates generic marketing approaches

The Power of Motivation-Based Segmentation

Motivation Intelligence offers wealth management professionals powerful tools to understand what drives financial decisions. This approach segments clients based on their core financial motivations rather than surface characteristics.

Motivation-based segmentation creates more precise client personas. Advisors can tailor investment recommendations, communication styles, and service delivery to match specific psychological profiles.

Primary motivation segments:

|

Motivation Theme |

Key Characteristics |

Communication Approach |

|

Security |

Risk-averse, stability-focused |

Emphasize protection and guarantees |

|

Growth |

Opportunity-driven, ambitious |

Highlight potential returns and market insights |

|

Legacy |

Family-oriented, long-term focused |

Discuss generational wealth transfer |

|

Control |

Independence-valued, self-directed |

Provide tools and information for decision-making |

Psympl partnered with Ipsos to develop a distinct financial psychographic model to identify wealth management clients’ motivations and “financial personalities.” The insights from this psychographic model power Psympl’s AI products to generate content specifically to each client’s (or prospect’s) psychographic profile.

This segmentation enables personalized portfolio construction and client engagement strategies. These insights can be applied to marketing messages, image choice, and user experience to truly personalize consumer interactions.

Financial firms using motivation-based approaches report higher client satisfaction and retention rates. Clients feel understood when advisors address their specific psychological drivers rather than making broad assumptions.

AI + Psychographics: A New Model for Personalized Wealth Engagement

Traditional wealth management relied on basic demographic and socioeconomic data like age,income, and net investable assets Today's firms are discovering a more sophisticated approach that combines artificial intelligence with psychographic insights.

Psychographic AI uses advanced algorithms to analyze behavioral data, values, interests, and attitudes. This technology allows wealth managers to understand clients beyond surface-level characteristics.

The model examines three core psychological dimensions:

|

Dimension |

Focus Area |

Application |

|

Values |

Core beliefs about money |

Investment philosophy alignment |

|

Motivations |

Financial goals and drivers |

Personalized strategy development |

|

Behavioral patterns |

Decision-making preferences |

Communication style adaptation |

Generative AI is fundamentally transforming wealth management by enabling these deeper personality-based insights. Advisors can now predict client reactions to market volatility or identify which investment approaches resonate most effectively.

Companies like Psympl have developed proprietary psychographic models that integrate consumer science with individual consumer data. Their approach combines demographics, socioeconomics, and purchase behaviors with a proprietary psychographic model to create highly predictive client profiles.

This technology moves beyond one-size-fits-all approaches. AI-driven personalization allows wealth management firms to process vast quantities of structured and unstructured data, generating actionable insights for truly personalized client interactions.

The result is more effective client engagement, improved satisfaction rates, and stronger advisor-client relationships built on deeper psychological understanding.

Turning Insights Into Action: The Path to Scalable Personalization

Wealth management firms face a critical gap between AI experimentation and meaningful implementation. While 78% of firms experiment with generative AI, only 41% scale adoption as core business practice.

The transition from data collection to actionable personalization requires structured approaches. Firms must move beyond basic client segmentation toward AI-driven personalization, informed with psychographic insights, that delivers proactive, data-driven engagement at every touchpoint.

Key Implementation Areas:

- Portfolio Management - Agentic AI handles proactive portfolio adjustments and complex workflow automation

- Client Onboarding - Streamlined processes driven by intelligent automation

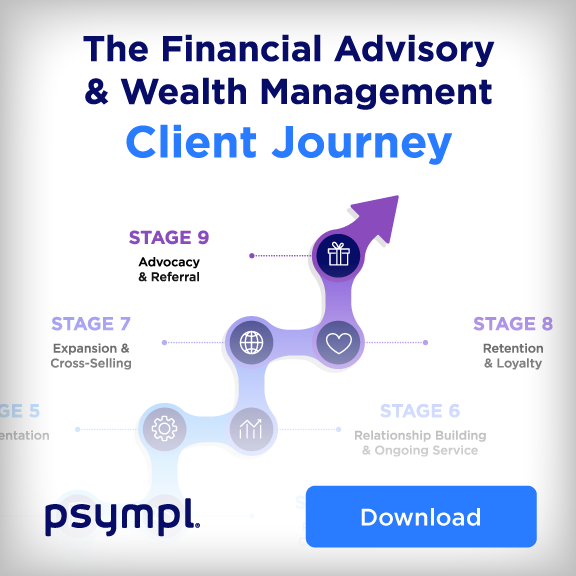

- Client Journey Mapping - Ensuring a consistent, personalized experience across all client touchpoints (CX).

- Risk Assessment - Real-time analysis of client financial profiles and market conditions

Mid-sized wealth management firms unify data platforms to deliver the "know me" service that tech-savvy investors expect. This approach transforms personalization into a driver of client loyalty and sustainable growth.

The path forward requires addressing data governance challenges. Implementation demands robust privacy protection and regulatory compliance frameworks to handle sensitive financial information securely.

AI simulation technologies now allow firms to test propositions at scale using real-time client insights, reducing implementation risks while maximizing strategic value.

Real-World Impact: From Client Retention to Revenue Growth

Wealth management firms are experiencing measurable results from AI implementation. 96% of financial advisors believe generative AI can revolutionize client servicing and investment management, with 97% expecting significant impact within three years.

Client Retention Enhancement

AI transforms client relationships through behavioral analysis,predictive data, and psychographic insights AI-driven systems detect subtle behavioral cues, forecast investment readiness, and recommend effective communication styles for each client segment based on their motivations.

Firms use AI to identify at-risk clients before they consider leaving. This proactive approach allows advisors to address concerns early and strengthen relationships.

Revenue Growth Acceleration

Organizations move beyond intuition-based selling to adopt systematic, evidence-based approaches to growth. AI analyzes client data to identify cross-selling opportunities and optimal timing for product recommendations.

Operational Efficiency Gains

|

AI Application |

Impact |

|

Portfolio Analysis |

Faster risk assessment |

|

Client Communication |

Personalized messaging at scale |

|

Compliance Monitoring |

Automated regulatory checks |

Despite widespread experimentation, only 41% of firms are scaling AI adoption as a core business component. This gap represents an opportunity for early adopters to gain competitive advantages.

Firms implementing AI report improved client satisfaction scores and increased assets under management. The technology enables advisors to focus on high-value activities while AI handles routine tasks.

Moving from Data-Rich to Decision-Ready

Wealth management firms collect massive amounts of client data daily. However, raw data alone provides little value without proper analysis and interpretation.

AI transforms this challenge by analyzing large amounts of data to deliver actionable insights. The technology processes market trends, client behaviors, and portfolio performance simultaneously.

Key transformation areas include:

- Real-time analysis - Market conditions change rapidly, requiring instant data processing

- Pattern recognition - AI identifies trends humans might miss in complex datasets

- Risk assessment - Automated evaluation of portfolio vulnerabilities and opportunities

- Client profiling - Dynamic updates to investor preferences and risk tolerance

Traditional wealth management often relies on manual processes and intuition. AI adds precision and scalability at every stage, enhancing the client experience (CX) from onboarding to portfolio management.

The technology enables advisors to move beyond reactive decision-making. They can now anticipate client needs and market shifts before they occur.

More than 75% of surveyed firms report that AI drives operational efficiencies and improved decision-making capabilities.

AI systems process thousands of data points in seconds. This speed allows wealth managers to respond to market opportunities while they remain profitable.

The shift creates competitive advantages for firms that embrace data-driven strategies. They deliver more precise recommendations and faster service responses than traditional approaches allow.

Move from data-rich to decision-ready.

Download Psympl’s Client Journey Infographic for Wealth Management and learn how to unlock actionable insights across every client touchpoint.

Brent Walker

Co-Founder & Chief Strategy Officer

.svg)