Modern banking customers expect seamless, personalized experiences at every touchpoint, yet most financial institutions struggle to deliver meaningful interactions despite collecting vast amounts of customer data. The disconnect between data collection and actionable insights has created a significant gap in customer experience that traditional analytics approaches cannot bridge.

The key to transforming banking customer journeys lies in combining artificial intelligence with deep psychological understanding to decode true customer intent and motivations. While banks have access to transaction histories, demographic information, and behavioral patterns, they often lack the ability to translate this data into personalized experiences that resonate with individual customers' emotional and financial needs.

Financial institutions that successfully integrate AI-driven insights with psychographic analysis can anticipate customer needs, reduce friction points, and create marketing strategies that genuinely enhance the customer experience. This approach moves beyond basic segmentation to understand the psychological drivers behind financial decisions, enabling banks to orchestrate customer journeys that feel intuitive and personally relevant rather than generic and transactional.

The Data Dilemma – Why Financial Services Struggle To Act On Insights

Banks collect massive amounts of customer data yet struggle to use it effectively. The financial sector faces a fundamental challenge in turning raw information into actionable customer journey improvements.

Data fragmentation across business units creates the primary obstacle. Private banking, mortgages, insurance, and asset management operate in separate systems that rarely communicate with each other.

Common Data Quality Issues:

- Incomplete customer records

- Duplicated information across systems

- Outdated contact details

- Inconsistent data formatting

- Missing transaction histories

Only 16 percent of banking executives trust their business data accuracy. This lack of confidence prevents teams from making strategic decisions about customer experience improvements.

Legacy systems compound the problem. Years of mergers and acquisitions have left financial institutions with incompatible platforms that store customer information differently. Integration becomes nearly impossible without significant technical investment.

Manual data entry and lack of standardization introduce human error into customer profiles. Teams often work with different versions of customer information, making unified journey mapping extremely difficult.

The result is clear: banks possess valuable customer insights but cannot act on them effectively. Without clean, integrated data, personalizing customer journeys remains more aspiration than reality for most financial institutions.

From Data To Decisions – How AI Unlocks True Customer Intent

Banking institutions collect massive amounts of customer data daily. Transaction histories, mobile app interactions, and communication logs create comprehensive digital footprints. Traditional analytics often miss the deeper patterns that reveal actual customer needs.

AI transforms this raw data into actionable intelligence. Machine learning algorithms analyze spending patterns, account usage, and behavioral signals to predict customer intent. Banks can now identify when customers are likely to need loans, investment advice, or new financial products.

Real-time decision engines process multiple data streams simultaneously. They detect subtle indicators like increased savings deposits suggesting mortgage readiness. Spending pattern changes might signal life events requiring new banking services.

Predictive analytics and machine learning models help financial institutions anticipate customer behavior before explicit requests occur. These systems identify cross-selling opportunities and potential churn risks with remarkable accuracy.

Natural language processing analyzes customer service interactions and feedback. Banks gain insights into emotional states and satisfaction levels. This technology reveals unspoken frustrations and preferences that surveys miss.

Key AI capabilities transforming banking decisions:

- Behavioral clustering identifies customer segments based on actual usage patterns

- Propensity scoring predicts likelihood of product adoption

- Sentiment analysis monitors customer satisfaction across all touchpoints

- Real-time personalization adapts offers based on current context

AI-powered customer journey mapping reveals non-linear paths customers take toward financial decisions. Banks can intervene at optimal moments with relevant solutions rather than generic promotions.

Understanding The Human Side – Using Psychographics To Identify Client Motivations

Banks often rely on basic demographic data like age and income to understand customers. This approach misses the deeper psychological factors that truly drive financial decisions.

Psychographic segmentation analyzes psychological factors, emotional drivers, and lifestyle preferences to create targeted strategies. For banking, this means understanding why clients choose specific financial products.

Key Psychographic Variables in Banking:

|

Variable |

Banking Application |

|

Values |

Security vs. growth preferences |

|

Lifestyle |

Digital-first vs. branch loyalty |

|

Attitudes |

Risk tolerance levels |

|

Interests |

Investment priorities |

A client's financial behavior stems from deep-seated beliefs about money, security, personal goals, and success. Understanding customer motivations through psychographic analysis reveals these hidden drivers.

Conservative clients prioritize stability and may prefer traditional savings accounts. Risk-takers might gravitate toward investment products and cryptocurrency options.

Young professionals may value convenience and mobile banking features. Retirees might prioritize personal relationships and face-to-face service. Important to keep in mind is that not all young professionals or retirees think alike or prioritize the same things. A “one size fits all” approach to these demographically-defined groups will fall flat among a high percentage of these customers.Businesses can understand client motives and purchase behavior by examining psychological traits. Banks can use surveys, behavioral analysis, and transaction patterns to identify these traits.

While a validated and effective psychographic model can require extensive resources (money, time, FTE capacity) to develop and operationalize, Psympl partnered with Ipsos to develop a robust financial psychographic model that can be leveraged immediately by banks, credit unions, wealth management firms, fintech, and financial services companies to greatly enhance marketing and customer engagement efforts.

This psychological insight allows banks to craft persuasive, personalized experiences that resonate emotionally. Products and services align with clients' core values rather than surface-level demographics.

Marketing As The CX Bridge – Connecting Insights To Action

Marketing teams serve as the operational bridge between customer experience insights and actionable strategies in banking. Marketing and CX alignment creates personalized touchpoints, predictive engagement models, and AI-driven optimization that transforms customer data into meaningful interactions.

Personalized Onboarding Campaigns

Banks leverage customer data from initial applications to create tailored onboarding sequences. New checking account holders receive different messaging than mortgage applicants or business banking customers.

Marketing automation platforms segment customers based on product selection, demographics, and stated financial goals. A first-time homebuyer receives educational content about mortgage processes, while a small business owner gets cash flow management resources. A psychographic lens enables banks and credit unions to engage customers on a more personal level, using content that resonates according to their motivations.

Email sequences adjust timing based on customer engagement patterns. High-engagement customers receive content every 3-4 days, while lower-engagement segments get weekly touchpoints to avoid overwhelming them.

Mobile app onboarding adapts interface tutorials based on customer age and digital proficiency scores. Younger customers see advanced features first, while older demographics receive step-by-step guidance for basic functions.

Branch visit scheduling integrates with CRM data to suggest relevant meeting topics. Customers who opened savings accounts receive invitations to discuss investment options, while those with multiple loans get debt consolidation consultations.

Predictive Cross-Sell Recommendations

Machine learning algorithms analyze transaction patterns, account balances, and life events to identify cross-selling opportunities. Banks track salary increases through direct deposits to trigger mortgage pre-approval campaigns.

Life stage indicators drive targeted product recommendations:

- Recent graduates get student loan refinancing offers

- New parents receive college savings plan information

- Retirement-age customers see annuity and wealth management content

Behavioral triggers activate specific campaigns. Customers maintaining high checking account balances for 90+ days receive investment account promotions. Those with declining balances get overdraft protection or line of credit offers.

Purchase category analysis reveals lifestyle changes. Increased baby-related spending triggers family banking product campaigns. Higher travel expenses prompt travel rewards credit card offers.

Marketing teams use propensity scores to prioritize outreach timing. Customers with 70%+ likelihood scores receive immediate contact, while lower scores enter nurture sequences for future engagement.

AI-Assisted Content And Timing Optimization

Artificial intelligence analyzes individual customer communication preferences to optimize message delivery. AI-driven insights determine whether customers prefer email, SMS, mobile app notifications, or phone calls.

Send time optimization algorithms track open rates across different times and days for each customer. Morning email openers receive future campaigns at 8 AM, while evening responders get 6 PM delivery.

Dynamic content generation personalizes messaging language and tone. Professional services customers receive formal communication, while younger demographics get conversational messaging with relevant financial tips.

A/B testing frameworks continuously refine subject lines, call-to-action buttons, and content length. Banks test 15-20 variations simultaneously across customer segments to identify highest-performing combinations.

Sentiment analysis of customer service interactions influences marketing message timing. Customers with recent positive experiences receive immediate cross-sell campaigns, while those with complaints enter retention-focused sequences first.

Orchestrating The Customer Journey In Banking With Psychographic AI

Banks are combining AI orchestration with psychographic data to create personalized customer journeys. This approach analyzes customer values, attitudes, and lifestyle preferences alongside traditional demographic information.

Psychographic AI-driven orchestration uses advanced analytics and machine learning to understand each customer's unique behavioral patterns and “financial personalities.” The system identifies optimal engagement moments based on psychological profiles.

Key Psychographic Profiles in Banking:

- Security-focused - Prioritize fraud protection and account safety

- Convenience-focused - Value quick transactions and seamless experiences

- Growth-oriented - Focus on investment opportunities and financial planning

- Relationship-focused - Prefer human interaction and personalized service

The technology enables banks to deliver contextually relevant experiences across all touchpoints. A risk-averse customer might receive proactive security alerts, while growth-focused clients see investment recommendations.

Banks can accurately attribute outcomes and optimize journeys by measuring psychographic responses to different AI interventions. This creates closed-loop learning systems.

Modern platforms analyze communication preferences, spending behaviors, and life stage indicators to predict customer needs. The AI adjusts messaging tone, channel selection, and product recommendations based on psychological profiles.

Implementation Benefits:

|

Aspect |

Traditional Approach |

|

|

Personalization |

Demographics only |

Behavioral + psychological |

|

Timing |

Scheduled campaigns |

Predictive moments |

|

Messaging |

One-size-fits-all |

Psychologically tailored |

This approach transforms reactive customer service into proactive relationship management that aligns with individual psychological drivers.

Measuring Success – Marketing Metrics That Reflect CX Impact

Banks need specific metrics to evaluate how customer experience improvements translate into marketing success. Traditional marketing metrics alone fail to capture the full impact of CX initiatives on customer relationships and business growth.

Net Promoter Score (NPS) measures customer loyalty and likelihood to recommend banking services. Banks can track NPS changes after implementing new digital features or streamlined processes. This metric directly connects customer satisfaction to organic growth potential.

Customer Lifetime Value (CLV) quantifies the total revenue a customer generates throughout their relationship with the bank. Enhanced customer experiences typically increase CLV by encouraging customers to use more services and maintain longer relationships.

Conversion rates across touchpoints reveal how well the customer journey performs at each stage. Banks should monitor conversion rates from initial awareness through account opening and product adoption.

|

Key CX Marketing Metrics |

What It Measures |

|

NPS |

Customer advocacy potential |

|

CLV |

Long-term customer value |

|

Conversion Rate |

Journey effectiveness |

|

Retention Rate |

Experience satisfaction |

Customer acquisition cost (CAC) often decreases when existing customers refer others due to positive experiences. Banks can track referral-driven acquisitions as a direct CX outcome.

Retention rates indicate whether customers remain satisfied with their banking experience. Higher retention typically results from consistent, positive interactions across all customer touchpoints.

Customer experience metrics help measure CX effectiveness by connecting satisfaction scores to business outcomes. Banks should align these metrics with their overall business goals for maximum impact.

Redefining The Customer Journey In Banking Through Psychographic AI

The combination of artificial intelligence and psychographic insights creates a powerful framework for transforming banking relationships. Banks can now move beyond traditional demographic segmentation to understand customer motivations, values, and behavioral patterns and generate persuasive content that resonates with each customer’s psychographic profile.

Psychographic AI-driven personalization enables financial institutions to deliver experiences that resonate with individual psychological profiles. AI is a strategic tool reshaping the way banks operate, serve customers and manage risks.

Machine learning algorithms analyze transaction patterns, communication preferences, and lifestyle choices to create comprehensive customer portraits. This data reveals whether customers prioritize security, convenience, social impact, or financial growth.

The integration transforms every touchpoint:

- Digital interfaces adapt to personality types

- Marketing is based on prospects’ and clients’ motivations

- Product recommendations align with values

- Communication timing matches behavioral patterns

- Service channels reflect preferred interaction styles

The transformation of customer experience in banking is increasingly driven by personalized,generative Psychographic AI solutions, which fundamentally changes how institutions connect with clients.

Banks implementing this approach see improved customer satisfaction, reduced churn, and increased cross-selling success. The technology enables proactive service delivery that anticipates needs before customers express them.

Trust remains essential as institutions navigate data privacy concerns and ethical AI implementation. The primary goals for marketers using AI are improving the customer experience and personalizing the customer journey.

Ready to turn insight into action?

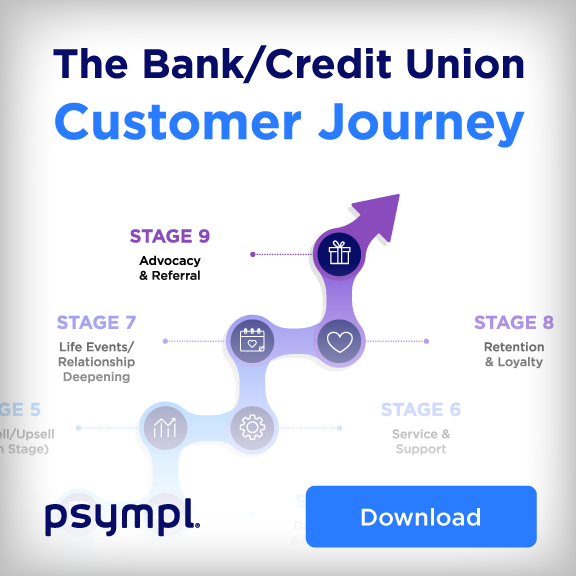

Download Psympl’s Customer Journey Infographic for Banking to see how AI and psychographics combine to personalize every stage of the bank customer journey in banking — from intent to motivation to lasting client relationships.

Brent Walker

Co-Founder & Chief Strategy Officer

.svg)