Modern customers expect financial institutions to know their preferences, anticipate their needs, and deliver relevant experiences across every touchpoint. Yet most banks and credit unions still rely on basic demographic segmentation that treats customers as numbers rather than individuals. Scaling personalization across customer experience requires combining AI-powered analytics with deep behavioral and psychographic insights to deliver individualized interactions that feel natural and timely.

Financial institutions face unique challenges when implementing personalized customer experiences at scale. Fragmented data systems, strict compliance requirements, and legacy technology create barriers that prevent most organizations from moving beyond simple name personalization in emails.

The solution lies in understanding why traditional approaches fail and how innovative institutions are using psychographic profiling alongside artificial intelligence to transform every customer interaction. Organizations that master this approach see revenue increases of 10-15% or more while building deeper customer relationships that drive long-term loyalty.

Why Financial Institutions Struggle To Scale Personalization

Despite significant investments in technology and talent, only 8 percent of banks can apply predictive insights from machine learning models to inform campaigns. Data fragmentation, outdated infrastructure, and regulatory complexity create barriers that prevent financial institutions from delivering personalized experiences at scale.

Siloed Data Creates Fragmented Experiences

Customer information remains scattered across departments and systems within most financial institutions. Only about 28 percent of banks have the ability to rapidly integrate internal structured customer data into their AI models.

This fragmentation prevents institutions from gaining a complete view of customer relationships. A customer might have a checking account managed by one system, a mortgage tracked in another, and investment products stored in a third platform.

Marketing teams cannot access real-time transaction data. Risk departments lack visibility into customer service interactions. Product teams make decisions without understanding cross-selling opportunities.

The result is disjointed customer experiences where institutions recommend products customers already own or fail to recognize high-value relationships. Financial institutions struggle with data silos that make it difficult to gain a holistic view of the customer.

Legacy Systems Limit Agility

Decades-old core banking systems create technical constraints that slow personalization efforts. These mainframe-based platforms were designed for transaction processing, not real-time customer engagement.

Integration challenges emerge when institutions attempt to connect legacy systems with modern analytics platforms. Data extraction processes that should take minutes require hours or days. Campaign deployment cycles stretch from weeks to months.

Just 16 percent of banks have standard protocols for algorithm development. Most analytics are developed on a campaign-by-campaign basis, which slows build times and limits the number of personalization initiatives that can be launched.

Legacy infrastructure lacks the flexibility to support dynamic customer segmentation or real-time decision-making. Batch processing cycles mean customer insights become outdated before campaigns reach market.

Compliance Concerns Restrict Creativity

Strict financial regulations create additional complexity for personalization initiatives. Only 14 percent of banks have a specific AI governance framework designed for modern personalization technologies.

Privacy regulations limit how institutions can collect, store, and use customer data for personalization purposes. Fair lending laws restrict certain types of algorithmic decision-making in product recommendations.

Risk management teams often apply traditional model governance approaches to AI-powered personalization tools. These processes were designed for credit risk models, not dynamic marketing algorithms that require frequent updates.

The result is conservative approaches to personalization that prioritize compliance over customer experience. Innovation cycles slow as legal and compliance teams review every algorithm change or new data source.

How AI And Psychographics Create Seamless CX

Modern customer experience relies on understanding psychological drivers rather than basic demographic data, while AI systems process behavioral patterns to predict customer intent and ensure privacy compliance throughout personalized interactions.

Moving Beyond Demographics

Traditional demographic segmentation fails to capture the complexity of modern customer behavior. Age, gender,location, and even household income or net assets provide limited insight into what motivates purchasing decisions or brand loyalty.

Psychographics examine psychological attributes including values, interests, attitudes, personality,and lifestyle choices. These factors reveal why customers make specific decisions rather than simply describing who they are demographically.

AI-powered personalization analyzes digital footprints to identify psychographic patterns at scale. Machine learning algorithms detect subtle behavioral cues that indicate customer motivations and preferences.

Key psychographic indicators include:

- Content consumption patterns

- Social media engagement styles

- Purchase timing and frequency

- Brand interaction preferences

- Problem-solving approaches

- Response variability to messaging and channels

Companies using psychographic data achieve higher engagement rates than those relying solely on demographics. Netflix uses viewing patterns and rating behaviors to understand entertainment preferences beyond age groups.

AI Unifies Data And Predicts Intent

Personalization at scale requires analyzing vast amounts of data to understand customer behaviors across multiple touchpoints. AI systems integrate information from websites, mobile apps, customer service interactions, and purchase histories.

Machine learning models identify patterns that predict future customer actions. These algorithms detect when customers are likely to purchase, upgrade services, or require support before explicit signals appear.

Real-time intent prediction enables:

|

Capability |

Application |

|

Dynamic pricing |

Adjusting offers based on purchase likelihood |

|

Content personalization |

Serving relevant information at optimal moments |

|

Proactive support |

Identifying frustration before complaints arise |

|

Channel optimization |

Directing customers to preferred interaction methods |

AI transforms CX strategies by processing behavioral data continuously. Systems learn from each interaction to refine future predictions and personalization accuracy.

The technology connects psychographic insights with real-time behavior. A customer showing analytical decision-making patterns receives detailed product comparisons, while emotion-driven buyers see lifestyle-focused content. Psychographic AI is a powerful tool for persuasive messaging and a satisfying customer experience.

Compliance-Ready Personalization

Privacy regulations require businesses to balance personalization with data protection. AI systems must deliver tailored experiences while maintaining compliance with GDPR, CCPA, and emerging privacy laws.

Modern personalization platforms implement privacy by design principles. These systems anonymize personal data while preserving the ability to create relevant customer experiences.

Balancing personalization and privacy requires transparent data usage policies. Customers need clear information about how their behavioral data creates personalized experiences.

AI enables compliance through automated data governance. Systems track consent preferences, manage data retention periods, and provide customers control over their information usage.

Compliance features include:

- Automated consent management

- Data minimization protocols

- Right to deletion capabilities

- Transparent algorithmic decisions

- Audit trail maintenance

Companies achieve effective personalization without compromising privacy by using aggregated behavioral patterns rather than individual identifiers. This approach maintains customer trust while delivering relevant experiences.

Building A Foundation For Scalable Personalization

Successful personalization requires three critical components: unified data systems, deeper customer insights beyond basic demographics, and seamless execution across multiple touchpoints. These elements work together to create the infrastructure needed for meaningful customer experiences at scale.

Step 1 — Clean And Connect Your Data

Data fragmentation remains the primary obstacle to effective personalization. Organizations often struggle with scattered customer information across departments and systems, preventing a unified customer view.

Companies must consolidate data from multiple sources into a single platform. This includes customer relationship management systems, e-commerce platforms, mobile apps, and offline interactions. The consolidation process requires data cleansing to remove duplicates and standardize formats.

Key data integration priorities:

- Customer transaction histories

- Website and app behavioral data

- Email engagement metrics

- Social media interactions

- Customer service touchpoints

Real-time data synchronization enables immediate personalization responses. Cloud-based solutions provide the scalability needed to handle varying data volumes without performance degradation.

Data governance policies ensure compliance with privacy regulations while maintaining data quality. Organizations need clear protocols for data collection, storage, and usage to build customer trust.

Step 2 — Integrate Psychographic Intelligence

Demographic and behavioral data alone cannot drive meaningful personalization. Behavioral analysis identifies patterns in customer actions across touchpoints. This includes purchase timing, content consumption habits, and engagement preferences. Psychographic intelligence reveals customer motivations, values, and preferences that inform more relevant experiences, identifying WHY people behave as they do. Advanced analytics platforms process these behaviors with psychographic insights to create detailed customer profiles.

Psychographic data sources:

- Survey responses and feedback

- Content engagement patterns

- Purchase decision factors

- Brand interaction preferences

- Lifestyle indicators

Machine learning algorithms identify customer segments based on psychological traits rather than basic demographics. These segments enable more precise targeting and messaging strategies.

Predictive analytics anticipate future customer needs based on psychographic profiles. This capability allows organizations to proactively address customer requirements before they explicitly express them.

While a developing and operationalizing an effective psychographic model is time, resource, and cost intensive, Psympl partnered with Ipsos to has develop a robust financial psychographic model for financial services, banks, credit unions and wealth management firms. This psychographic model is backed by more than 20 years of successfully operationalizing psychographics to achieve significant customer acquisition, retention, and behavior modification success.

Psympl’s products can integrate with existing customer data platforms to ensure psychographic insights enhance rather than replace current personalization efforts.

Step 3 — Activate Across Channels

Personalization across multiple touchpoints requires coordinated execution to maintain consistent customer experiences. Channel activation transforms data insights into actionable customer interactions.

Cross-channel orchestration ensures message consistency while adapting content to each platform's unique characteristics. Email campaigns, website experiences, mobile notifications, and social media content must align with individual customer profiles.

Channel activation components:

- Dynamic content management systems

- Automated trigger campaigns

- Real-time recommendation engines

- Personalized landing pages

- Contextual messaging platforms

Testing frameworks measure personalization effectiveness across channels. A/B testing validates which personalized experiences drive the highest engagement and conversion rates.

Campaign automation platforms scale personalization efforts without increasing operational complexity. These systems automatically adjust messaging based on customer behavior and preferences.

Performance monitoring tracks personalization impact on key business metrics. Organizations need visibility into how personalized experiences affect customer lifetime value and retention rates.

The Payoff: Seamless CX That Scales

Organizations that successfully implement personalization at scale see 1.7 times higher revenue growth year over year. This growth stems from creating customer experiences that encourage repeat engagement and build lasting brand loyalty.

Key Business Benefits:

|

Benefit |

Impact |

|

Revenue Growth |

1.7x higher year-over-year |

|

Customer Retention |

Increased repeat interactions |

|

Operational Efficiency |

Streamlined processes |

|

Brand Loyalty |

Enhanced customer relationships |

The technology foundation enables companies to process vast amounts of data and generate actionable insights in real time. Cloud and AI technologies make complex personalization practical for businesses of all sizes.

From the customer perspective, personalization at scale experiences are seamless and helpful. These interactions can seem effortless to users while delivering meaningful value at every touchpoint.

Critical Success Factors:

- Unified customer data across all channels

- Real-time processing capabilities

- Coordinated systems enterprise-wide

- Actionable customer profiles for immediate use

Companies achieve this by integrating smart automation, flexible workforce models, and streamlined processes. The result is exceptional customer experiences that maintain quality while serving high volumes of interactions.

The payoff extends beyond immediate revenue gains to sustainable competitive advantages in customer engagement,market positioning, and lifetime customer value and share of wallet..

Ready To Redefine Personalization In Financial Services?

Financial institutions stand at a critical juncture where customer expectations demand more than generic banking experiences. Today's customers expect seamless, personalized experiences that feel meaningful and secure.

The transformation requires strategic focus across multiple areas. Organizations must address fundamental challenges before achieving personalization at scale.

Key Implementation Areas:

- Data Integration - Centralize scattered customer information across departments

- Technology Modernization - Upgrade legacy systems to support advanced analytics

- Regulatory Alignment - Ensure compliance with privacy regulations

- Security Enhancement - Implement robust measures for sensitive financial data

Only 15% of B2C consumers say financial services providers are meeting expectations for personalized experiences. This gap presents significant opportunity for institutions ready to invest in transformation.

The path forward involves leveraging Psychographic AI-driven algorithms to analyze customer behavior and transaction history. These technologies enable institutions to deliver targeted product recommendations and anticipate customer needs proactively.

Expected Outcomes:

|

Benefit |

Impact |

|

Customer Experience |

Enhanced satisfaction through relevant interactions |

|

Revenue Growth |

Increased cross-selling and conversion rates |

|

Operational Efficiency |

Automated processes reduce manual intervention |

Financial institutions that embrace comprehensive personalization strategies position themselves to build lasting customer relationships. The investment in data-driven personalization technologies creates competitive advantages in an evolving marketplace.

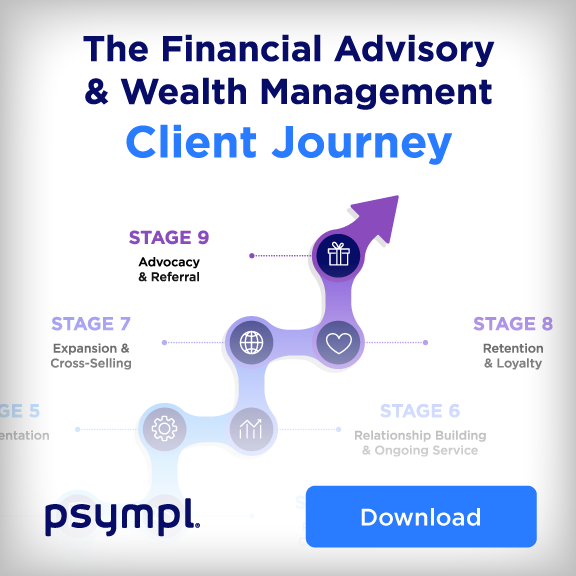

Download Psympl's Client Journey CX Infographic to see how psychographics and AI help financial institutions deliver seamless, compliant, and scalable personalization from first touch to lasting relationships.

Brent Walker

Co-Founder & Chief Strategy Officer

.svg)