Credit unions face a challenging reality. Members can access competitive rates from countless financial institutions with a few taps on their phones, making traditional differentiators like slightly lower loan rates or higher savings yields less effective at building lasting relationships.

The institutions that thrive today are those that understand member experience has become the primary competitive advantage in financial services. Research shows that 86% of members would pay more for a better member experience, yet only 20% of members in the credit union industry feel genuinely engaged with their institution. This gap represents both a challenge and an opportunity for credit unions willing to prioritize meaningful member interactions.

The shift from competing on rates to competing on experience requires credit unions to rethink how they serve members across every touchpoint. From digital banking interfaces to branch interactions, from financial education to problem resolution, each moment shapes whether members stay loyal or explore alternatives. Understanding how to deliver exceptional experiences while maintaining the community-focused values that define credit unions determines which institutions will build deeper relationships and sustainable growth.

Introduction

Credit unions operate on a fundamentally different model than traditional banks. They serve members rather than members, focusing on cooperative values and community impact.

Member experience encompasses every interaction a person has with their credit union. This includes opening accounts, applying for loans, resolving issues, and accessing digital services. Each touchpoint shapes how members perceive the value and quality of their financial institution.

Credit unions outperform traditional banks by 74 points in member satisfaction, particularly in trust, people, and problem resolution. However, this advantage only materializes when credit unions deliver consistently excellent experiences across all channels.

The financial landscape has changed dramatically in recent years. Members now expect seamless digital experiences combined with personalized service. They want mobile-first solutions, instant support, and the human touch that defines credit union culture.

Key elements of member experience include:

- Digital accessibility and ease of use

- Quality of in-person interactions

- Speed and efficiency of services

- Personalization and relevance

- Trust and transparency

Credit unions face unique challenges in meeting these expectations. They must balance technological innovation with the personal relationships that set them apart. Limited budgets and resources require strategic decisions about where to invest in improving member experience.

The stakes are high. Members who feel valued and well-served become loyal advocates. Those who encounter friction or indifference may seek alternatives. Understanding what drives exceptional member experience helps credit unions strengthen their competitive position while staying true to their cooperative mission.

Competing Beyond Pricing: Why Experience Matters More Than Ever

Credit unions traditionally relied on better rates and lower fees to attract members, but those advantages no longer guarantee competitive success. Members now prioritize seamless interactions and personalized service over marginal rate differences.

Pricing Advantages Are Shrinking

The gap between credit union rates and those offered by banks has narrowed significantly in recent years. Many large banks now match or come close to credit union rates on popular products like savings accounts and auto loans. Online-only banks have entered the market with competitive rates that sometimes exceed what credit unions can offer.

Rate comparison tools and mobile apps make it easy for consumers to find the best deal within seconds. This transparency means members can quickly switch institutions if they find a slightly better rate elsewhere. Credit unions that compete solely on pricing find themselves in a race to the bottom that erodes margins and limits their ability to invest in other areas.

The cost advantage that once defined credit unions has become less meaningful to members who value convenience and digital capabilities. Younger generations especially show willingness to pay slightly higher rates in exchange for superior technology and user experience.

Experience Has Become the True Differentiator

Acquiring a new member costs five to 25 times more than keeping an existing one, making retention through excellent experience financially critical. Credit unions that focus on delivering exceptional member experiences create loyalty that transcends rate shopping.

Members expect intuitive digital platforms, instant support, and personalized financial guidance. The 78% of credit union members who prefer digital banking through mobile apps or websites demand experiences comparable to leading fintech companies. Credit unions that invest in user-friendly interfaces, AI-driven tools, and seamless omnichannel service create emotional connections that rates alone cannot achieve.

Key experience factors that drive loyalty:

- Real-time account access and transaction notifications

- Personalized product recommendations based on spending patterns

- Fast response times across multiple communication channels

- Proactive financial wellness support and education

- The feeling that the credit union really knows the member and values the relationship

Marketing leaders recognize this shift, with 81% expecting to compete mostly or completely on member experience. Credit unions that maintain their community values while embracing modern technology position themselves as irreplaceable partners rather than interchangeable commodity providers.

Understanding What Clients Really Want From Their Financial Institution

Credit union members seek experiences that align with their individual financial situations and life circumstances, not generic services based solely on age brackets or account balances. Members value institutions that recognize their unique preferences, communication styles, and financial aspirations.

Moving Beyond Demographics and Transaction Data

Traditional demographic segmentation fails to capture the nuanced preferences that drive member satisfaction and loyalty. A 35-year-old small business owner has vastly different needs than a 35-year-old teacher, yet basic demographic data treats them identically.

Transaction data reveals what members do but not why they do it. A member who frequently transfers money between accounts might be managing cash flow challenges, saving for multiple goals, or simply organizing their finances. Without understanding the motivation, credit unions cannot provide relevant guidance or product recommendations.

Member satisfaction encompasses trust, convenience, and personalized services that extend beyond simple transactions. Members expect their financial institution to understand their individual circumstances and offer solutions tailored to their specific situations rather than one-size-fits-all products.

Psychographic Insights Unlock Personalization at Scale

Psychographic data captures members' attitudes, values, lifestyle choices, and the motivations behind financial behaviors. This information enables credit unions to segment members based on shared mindsets rather than surface-level characteristics.

A risk-averse member who values security prioritizes different features than a growth-oriented member who embraces calculated risks. Understanding these psychological profiles allows credit unions to customize messaging, product offerings, and communication channels effectively.

Financial stress levels, spending priorities, and long-term goals vary significantly among members with similar demographics. AI-driven insights into transaction patterns, spending habits, and financial goals help credit unions deliver targeted promotions and proactive solutions. Credit unions can identify members approaching major life events like home purchases or retirement and provide timely, relevant guidance that demonstrates genuine understanding of their needs.

How Banks and Credit Unions Can Compete on Experience Today

Financial institutions gain competitive advantage by understanding member psychology, equipping staff with behavioral insights, and delivering personalized digital interactions based on individual financial mindsets and life circumstances.

Use Psychographic Data to Tailor Member Journeys

Psychographic data reveals member attitudes, values, and motivations behind financial behaviors beyond basic demographics. Credit unions collect this information through account activity patterns, product usage, and engagement preferences to segment members into distinct groups.

A member who consistently saves for long-term goals requires different messaging than one focused on immediate liquidity needs. Financial institutions analyze spending categories, savings frequency, and loan inquiry patterns to identify these behavioral profiles.

Psympl offers a validated financial psychographic model for credit unions to use in marketing, member engagement, and CX initiatives. This model identifies each member’s psychographic profile to guide motivation-based and persuasive content and experiences.

Omnichannel experience platforms integrate this data across touchpoints to trigger relevant communications. When a member shows signs of debt accumulation through transaction analysis, the system can automatically present debt consolidation options through their preferred channel.

This approach moves beyond treating all members identically. Institutions identify specific life stages, risk tolerances, and financial priorities to match products and services with actual member needs rather than generic campaigns.

Build Advisor and Staff Conversations Around Member Mindsets

Branch staff and member service representatives need access to psychographic insights during interactions. Training programs teach employees to recognize financial mindsets and adapt their communication style accordingly.

A member anxious about market volatility requires reassurance and education about diversification. Another member comfortable with risk may prefer discussions about growth opportunities and higher-yield products. Staff access to member preference data enables these nuanced conversations.

Technology systems using Psychographic AI surface relevant member information before interactions begin. Representatives see recent account activity, product interests indicated through digital browsing, and communication preferences. This preparation allows staff to address specific concerns rather than starting conversations from scratch.

Community-centric institutions like Tandia Financial Credit Union use configurable systems to ensure staff have context about member needs. The result is more productive conversations that strengthen relationships and increase product adoption.

Create Hyper-Relevant Digital Experiences

Digital platforms must adapt content based on individual member data in real time. Members logging into online banking see offers and information aligned with their current financial situation and demonstrated interests.

Personalization engines analyze multiple data points:

- Transaction history - Recent purchases and spending patterns

- Life events - Major deposits, address changes, or account modifications

- Product holdings - Current accounts, loans, and investment products

- Digital behavior - Pages viewed, applications started, and time spent on specific features

A member who recently made a large purchase on a credit card might see balance transfer offers. Someone approaching mortgage renewal receives rate comparisons and refinancing information. AI-powered systems deliver these experiences automatically without manual intervention.

The digital experience extends beyond account access. Promotional emails link to landing pages pre-populated with member information, reducing friction in application processes. Mobile apps adjust their interface based on most-used features for each individual.

The ROI of Competing on Experience Instead of Rates

Credit unions that prioritize member experience over rate competition see measurable returns through reduced member churn, organic growth from referrals, and lower member acquisition costs. These financial benefits compound over time as satisfied members become long-term advocates.

Higher Retention and Lower Churn

Member retention directly impacts profitability because existing members cost significantly less to serve than acquiring new ones. Credit unions that implement data-driven member experience strategies can detect dissatisfaction early through real-time sentiment tracking and proactive issue resolution.

When credit unions integrate Net Promoter Score data into their CRM systems, frontline staff can address concerns before members consider leaving. This approach prevents attrition by resolving problems when they're still manageable. Members who feel heard and valued are less likely to switch institutions for a marginally better rate elsewhere.

Key retention metrics to track:

- Member churn rate by product type

- Average member relationship length

- Cross-product adoption rates

- Response time to member complaints

The lifetime value of a retained member far exceeds the cost of rate-based promotions used to replace churned accounts.

Increased Referrals and Word-of-Mouth Growth

Members who have positive experiences become organic marketing channels through referrals and recommendations. According to research, 81% of marketing leaders expect to compete on member experience rather than product features alone. Members of one particular psychographic segment in Psympl’s psychographic model pride themselves on being peer chat-leaders, most likely to share their opinions and advice regarding financial matters. Nurturing this particular group as ambassadors for the credit union is key to winning word-of-mouth.

Credit unions leveraging ROI-driven member experience often implement personalized financial incentives for active referrers. Members who consistently recommend the credit union may receive better loan rates or cashback rewards. This creates a virtuous cycle where satisfied members bring in qualified prospects who are more likely to be engaged.

Word-of-mouth referrals typically convert at higher rates than paid advertising because they come with built-in trust. New members acquired through referrals also tend to have longer relationships and higher product adoption rates.

More Efficient Marketing Spend

Credit unions that excel at member experience reduce their reliance on expensive acquisition campaigns and promotional rates. By using predictive analytics and segmentation, they can identify high-value prospects and tailor campaigns accordingly.

Digital self-service tools and AI-driven onboarding processes lower operational costs while improving convenience. These investments in digital transformation reduce the need for in-branch visits and manual processing.

Cost-saving opportunities include:

- Automated “Know Your Member” procedures

- AI chatbots handling routine inquiries

- Streamlined application processes

- Reduced branch staffing requirements

Credit unions can quantify ROI by tracking cost reductions from automation alongside increased conversion rates from improved digital experiences. Marketing dollars stretch further when they're supporting a superior experience rather than compensating for service gaps with aggressive rate offers.

The Path Forward: Personalization Without Complexity

Credit unions face a critical challenge: delivering personalized experiences that resonate at every touchpoint while avoiding operational overwhelm. The solution lies in implementing strategic, scalable approaches rather than attempting complete transformation overnight.

Start with member data analysis. Credit unions already possess valuable information about member behaviors and preferences. Advanced analytics and AI enable understanding members on a deeper level while delivering personalized experiences at scale.

Technology integration doesn't require replacing entire systems. Credit unions can adopt targeted solutions that enhance existing infrastructure:

- CRM platforms that centralize member information

- Communication tools tailored to member preferences

- Feedback mechanisms for real-time insights

- Analytics dashboards that identify personalization opportunities

Employee engagement remains fundamental to personalization success. Staff equipped with proper training and tools become ambassadors for member-centric service. They transform routine interactions into meaningful connections that build loyalty.

Credit unions should focus on relevancy, value, and adaptability when developing their personalization strategy. This means identifying specific member segments and tailoring services to their distinct needs rather than creating countless individual approaches.

The most successful credit unions implement personalization gradually. They select one product line or service area, refine their approach, then expand. This measured strategy builds momentum while maintaining operational stability and preserving what makes each institution unique.

Conclusion

Credit unions face a critical decision point in how they shape their member relationships. The data shows clear patterns: 92% of consumers trust recommendations from friends and relatives over other advertising forms, making satisfied members invaluable advocates.

The path forward requires balancing technology with personal connection. Members want efficiency and convenience, but they also need to feel genuinely valued. This means implementing digital tools while maintaining the human touch that distinguishes credit unions from traditional banks.

Key priorities include:

- Personalized financial education tailored to individual needs

- Seamless experiences across all channels

- Employee training that emphasizes quality service

- Data-driven decision making based on satisfaction metrics

Credit unions that embrace technological innovation while staying true to their member-first philosophy position themselves for sustained success. The gap in member engagement that currently exists presents an opportunity rather than a limitation.

Success depends on consistent execution across multiple touchpoints. Whether members interact through mobile apps, branches, or online platforms, they expect the same level of service and attention. Credit unions must measure what matters and adjust strategies based on actual member feedback and behavior patterns.

The institutions that thrive will be those making deliberate choices to improve member satisfaction and service delivery through practical improvements. Small changes often yield significant results when they address genuine member needs and remove friction from everyday interactions.

Ready to turn stronger member experiences into measurable growth?

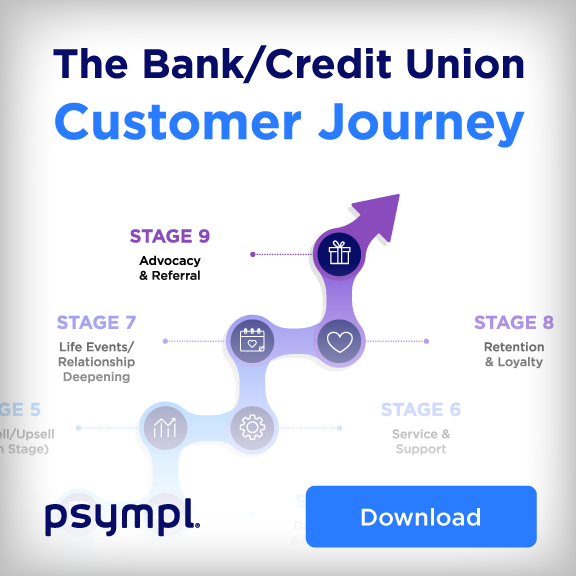

Download Psympl’s Credit Union and Banking CX Journey Infographic to see how the modern credit union member thinks, decides, and engages across every touchpoint. This quick-reference guide reveals where friction occurs, what moments matter most, and how psychographic insights can elevate your member journey from “good” to truly differentiated.

Brent Walker

Co-Founder & Chief Strategy Officer

.svg)