Most financial advisors believe they deliver exceptional client experiences, yet clients often feel disconnected and frustrated when moving between digital platforms and face-to-face meetings. The reality is that traditional wealth management has created fragmented touchpoints where clients receive different levels of service, conflicting information, and disjointed communications across various channels.

The key to transforming advisor client experience lies in creating seamless integration between human-led interactions and digital touchpoints through unified data and psychographic insights. This integration allows advisors to deliver consistent, personalized experiences whether clients are meeting in person, accessing online portals, or engaging through mobile applications.

The shift toward connected experiences represents more than just technological improvement. It fundamentally changes how wealth managers can redefine the client relationship by breaking down silos between different service delivery methods. When advisors successfully bridge the gap between digital efficiency and personal touch, they create competitive advantages that drive client retention, referrals, and sustainable growth.

Why The Advisor Client Experience Must Be Seamless Across All Channels

Today's clients interact with financial advisors through multiple touchpoints simultaneously, expecting consistent service whether they're using mobile apps, attending virtual meetings, or visiting physical offices. The integration of human expertise with digital convenience has become essential for maintaining client satisfaction and competitive advantage.

Digital Expectations Have Changed

Modern clients expect financial advisors to provide consistent branding and messaging across all platforms, from social media to email communications. These expectations mirror their experiences with other service industries where seamless digital interactions are standard.

Clients frequently begin their research on websites, continue conversations through secure messaging platforms, and complete transactions via mobile apps. Each interaction must feel connected to previous touchpoints rather than isolated experiences.

Key Digital Expectations:

- Instant access to account information across devices

- Consistent visual branding and messaging tone

- Synchronized data between online and offline interactions

- Real-time updates on portfolio changes and market events

When advisors fail to meet these expectations, clients often perceive the service as outdated or unprofessional. Building a client service model requires understanding what clients need across every digital touchpoint.

The most successful advisory firms now treat digital channels as extensions of their personal service rather than separate offerings.

Human And Digital Roles Are Merging

The traditional boundary between digital tools and personal advisory services continues to blur as clients expect both convenience and human expertise. Successful independent financial advisors deliver exceptional experiences at every stage by combining technology with personal relationships.

Advisors now use digital platforms to enhance rather than replace human interactions. Video conferencing allows for face-to-face meetings without geographic constraints, while client portals provide 24/7 access to information between scheduled consultations.

Merged Experience Elements:

- Digital scheduling tools paired with personalized consultation agendas

- Automated portfolio updates followed by advisor commentary

- Online document sharing with real-time collaboration features

- Mobile apps that trigger advisor notifications for urgent client needs

Integrated communications across phone, web, email, and in-person channels create seamless experiences that feel both efficient and personal.

Clients increasingly expect their advisors to be accessible through their preferred communication methods while maintaining the same level of expertise and attention across all channels.

The Problem: Siloed Data And Fragmented Journeys

Financial advisors struggle with disconnected systems that prevent comprehensive client understanding, while digital platforms fail to capture the nuanced conversations that drive investment decisions. These data silos create inefficiencies and collaboration barriers that directly impact client satisfaction.

Advisors Lack Full Context Without Unified Data

Advisory firms typically operate with separate systems for client relationship management, portfolio tracking, compliance documentation, and communication logs. This fragmentation leaves advisors without complete visibility into client interactions and preferences.

When client data exists across multiple platforms, advisors cannot access comprehensive histories during client meetings. They may review recent portfolio performance in one system while client preferences remain stored in another platform entirely.

Critical information gaps include:

- Previous conversation topics and client concerns

- Family financial goals across different accounts

- Investment timeline changes and life events

- Communication preferences and contact history

Disconnected client details and isolated project information create lose-lose scenarios where advisors appear uninformed about client needs. This lack of context forces clients to repeat information and undermines confidence in the advisory relationship.

The manual effort required to gather information from disparate systems consumes valuable meeting time. Advisors spend minutes searching for basic client details instead of focusing on strategic financial planning discussions.

Digital Channels Do Not Reflect Advisor Conversations

Client portals and mobile applications operate independently from advisor communication systems, creating disconnected experiences that confuse clients about their financial status and recent discussions.

Common disconnection points include:

- Portfolio updates that ignore recent rebalancing conversations

- Digital goal tracking that differs from advisor recommendations

- Account alerts that contradict advisor guidance

- Investment research that excludes personalized strategy discussions

Clients expect their digital experience to reflect conversations with their advisor. When online dashboards show generic information while advisors discuss specific strategies, fragmented interactions damage customer loyalty and revenue.

The technology disconnect becomes particularly problematic during market volatility. Clients may receive automated portfolio alerts through digital channels while their advisor has already addressed these concerns in recent conversations.

Data fragmentation causes teams to waste hours chasing answers while clients receive inconsistent information across touchpoints. This misalignment forces clients to validate which source provides accurate guidance for their financial decisions.

The Solution: Psychographic Data As The Bridge

Psychographic insights reveal the underlying motivations that drive client financial decisions, moving beyond surface-level demographics. This deeper understanding enables advisors to create meaningful connections through both personal conversations and technology-driven touchpoints.

Understanding Motivations Behind Financial Behavior

Financial psychographic segmentation dives into the psyche of individuals, revealing how values, beliefs, and lifestyles shape financial decisions. This approach allows advisors to match strategies and products to diverse client profiles with precision.

Traditional demographic data shows that a client is 45 years old with a $500,000 income. Psychographic data reveals whether they prioritize security over growth, legacy building over personal enjoyment, or ESG alignment over pure returns.

Advisors can identify specific behavioral patterns through targeted discovery:

- Risk tolerance origins: Understanding if conservative tendencies stem from past financial trauma or cultural upbringing

- Decision-making preferences: Determining whether clients prefer data-driven analysis or relationship-based guidance

- Communication styles: Recognizing preferences for detailed reports versus high-level summaries

- Value hierarchies: Identifying what truly matters most in financial planning decisions

Client discovery conversations serve as the primary method for uncovering these insights. These discussions move beyond account balances to explore emotional connections to money and long-term aspirations.

Powering Both Human And Digital Interactions

Psychographic insights enhance every client touchpoint, from face-to-face meetings to digital platform interactions. Advisors can tailor communication frequency, content depth, and presentation style based on individual psychological profiles.

Human interactions benefit through personalized conversation approaches. Analytical clients receive detailed market research and performance metrics. Relationship-focused clients get more time discussing family goals and life transitions.

Digital experiences adapt to psychological preferences automatically. Conservative investors see stability-focused dashboards with risk management highlights. Growth-oriented clients receive market opportunity alerts and performance comparisons.

AI-driven platforms use psychographic data to customize portal layouts, notification timing, and content recommendations. The technology learns from behavioral patterns to predict information needs.

Implementation requires systematic data collection and application:

|

Psychographic Trait |

Human Application |

Digital Application |

|

Detail-oriented |

Comprehensive reports |

Extended analytics views |

|

Relationship-focused |

Personal check-ins |

Family goal tracking |

|

Tech-savvy |

Digital-first communication |

Advanced tool access |

This dual approach ensures consistency across all interaction channels while respecting individual communication preferences.

How To Align Advisor-Led And Digital Experiences

Creating seamless alignment requires unifying client data across all touchpoints, standardizing messaging based on client psychology, implementing AI-driven personalization, and establishing feedback mechanisms that inform both human and digital interactions.

Step 1: Unify Client Data Into A Single View

Advisors need connected data infrastructure that extends across all practice areas to deliver consistent experiences. Data from client interactions, portfolio performance, and communication preferences must flow seamlessly between digital platforms and advisor systems.

This unified approach eliminates discrepancies between what clients see in their digital portals and what advisors discuss during meetings. Real-time synchronization ensures both channels reflect identical account balances, transaction histories, and investment recommendations.

Essential data points to consolidate:

- Account holdings and performance metrics

- Communication preferences and interaction history

- Risk tolerance and investment objectives

- Life events and financial goal updates

- Document access and compliance records

The integration prevents situations where clients receive conflicting information across channels. When advisors update client profiles or investment strategies, these changes immediately reflect in digital experiences.

Step 2: Use Psychographics To Standardize Messaging

Client communications require a consistent tone and messaging framework across both advisor conversations and digital touchpoints. Psychographic profiling helps determine whether clients prefer detailed analytics or simplified summaries.

Common psychographic traits:

- Analytical clients: Prefer detailed data, charts, and technical explanations

- Relationship-focused clients: Value personal connection and simplified communications

- Results-oriented clients: Want performance summaries and actionable recommendations

- Security-conscious clients: Need reassurance about risk management and compliance

Psympl has developed a financial psychographic model for wealth managers, banks, and financial services firms that can be immediately leveraged to easily and efficiently identify clients’ and prospects’ psychographic profiles. Moreover, Psympl offers tools such as the PsymplifierTM, powered by Psychographic AITM, to automatically generate content (e.g., emails, text messages, call/discussion scripts, social media, etc.) that is hyper-personalized to the client’s/prospect’s motivations and psychographic profile. Advisors can use these profiles to customize their verbal explanations while ensuring digital platforms deliver information in matching formats. A client who appreciates detailed portfolio analysis during meetings should receive equally comprehensive digital reports.

This standardization builds trust by creating predictable communication patterns. Clients know what to expect from both human and digital interactions.

Step 3: Embed AI-Driven Personalization Across Channels

AI-driven platforms can analyze client behavior patterns to customize both digital interfaces and advisor preparation materials. The technology identifies which information clients access most frequently and when they prefer to engage.

Machine learning algorithms track client portal usage, email open rates, and meeting discussion topics to create personalization profiles. These insights help advisors prepare relevant talking points while ensuring digital experiences surface the most pertinent information.

AI personalization applications:

- Dashboard customization based on client priorities

- Automated alert preferences for portfolio changes

- Content recommendations aligned with financial goals

- Meeting agenda suggestions based on recent digital activity

- Marketing content for client acquisition, retention, or upsell/cross-sell

The system learns from both digital interactions and advisor notes to refine personalization over time. This creates a feedback loop that improves both channel experiences simultaneously.

Step 4: Enable Continuous Feedback Loops

Establishing mechanisms to capture client preferences from both advisor meetings and digital interactions ensures ongoing alignment improvements. Regular feedback collection identifies gaps between what clients want and what each channel delivers.

Post-meeting surveys and digital platform analytics provide quantitative data about client satisfaction across touchpoints. This information helps firms adjust both advisor training and technology configurations.

Feedback collection methods:

- Brief post-meeting satisfaction surveys

- Digital platform usage analytics and heatmaps

- Quarterly experience reviews covering both channels

- Client advisory panels to discuss channel preferences

The feedback helps identify when clients prefer human interaction versus digital self-service for specific tasks. Some clients want to discuss major investment decisions with advisors but prefer handling routine tasks digitally.

Regular analysis of this feedback enables firms to optimize the balance between human and digital experiences for different client segments.

Real Use-Case Examples

Modern advisor-client relationships benefit from strategic technology integration that enhances personal touchpoints and behavioral insights. These implementations demonstrate how firms combine digital tools with human expertise to create more responsive and effective client experiences.

Personalized Advisor Follow-Up Informed By Digital Behavior

Advisors track client digital interactions to customize their communication timing and content. When clients spend significant time reviewing portfolio performance dashboards or researching specific investment topics, advisors receive automated alerts with detailed behavioral data.

Key behavioral triggers include:

- Extended time on retirement planning calculators

- Repeated visits to market commentary sections

- Downloads of educational materials on specific topics

- Mobile app engagement patterns during market volatility

Successful implementations show advisors contacting clients within 24-48 hours of significant digital activity. They reference the specific content the client viewed and prepare targeted talking points based on the client's demonstrated interests.

Valur's advisor collaboration process demonstrates this approach through their five-stage client journey. Their system tracks client interactions with online calculators and educational content, enabling advisors to tailor conversations around specific tax planning strategies.

The most effective advisors use this data to shift from generic check-ins to value-driven conversations. They prepare customized materials and talking points that directly address the topics clients have been researching independently.

Digital Nudges That Reinforce Advisor Recommendations

Technology platforms send strategic prompts to clients that support advisor guidance between meetings. These nudges appear as mobile notifications, email reminders, or in-app messages that encourage specific actions discussed during advisor consultations.

Effective nudge categories include:

- Contribution reminders aligned with cash flow discussions

- Rebalancing alerts when portfolios drift from target allocations

- Document upload prompts for pending account updates

- Educational content related to recent advisor recommendations

Financial planning technology solutions enable firms to automate these touchpoints while maintaining the advisor's strategic direction. The key is timing nudges to reinforce conversations rather than replace them.

Successful firms customize nudge frequency and messaging tone based on client communication preferences. High-touch clients receive more frequent prompts, while self-directed clients get periodic strategic reminders.

The most impactful nudges include specific next steps and deadlines that connect directly to the client's financial goals discussed with their advisor.

Journey Mapping That Leverages Client Psychographics

Firms develop multiple client experience pathways based on behavioral profiles and communication preferences rather than using a single standardized process. Each path includes different touchpoint frequencies, communication channels, and decision-making timeframes.

Common psychographic characteristics include:

|

Characteristic |

Communication Style |

Meeting Frequency |

Digital Preference |

|

Analytical |

Data-heavy reports |

Quarterly |

High dashboard usage |

|

Collaborative |

Interactive discussions |

Monthly |

Video calls preferred |

|

Delegator |

Executive summaries |

Bi-annually |

Email updates |

Professional services firms using client feedback processes demonstrate how psychographic mapping improves satisfaction scores. They adjust communication frequency, meeting formats, and information depth based on client personality assessments.

Effective implementations include intake questionnaires that identify communication styles and decision-making preferences. Advisors then follow mapped pathways that match each client's preferred interaction style.

The most sophisticated firms update these mappings based on evolving client behaviors and feedback, ensuring the experience remains aligned with changing preferences throughout the relationship lifecycle.

Business Impact: What A Unified Advisor Client Experience Delivers

A unified client experience creates measurable business outcomes for financial advisory firms. RIAs that embrace experience measurement as a core business strategy gain a sustainable competitive advantage.

Client Retention & Loyalty

Consistent experiences across all touchpoints strengthen advisor-client relationships. Clients develop deeper trust when interactions feel seamless and coordinated.

Higher retention rates reduce client acquisition costs. Loyal clients also generate more predictable revenue streams for advisory practices.

Referral Generation

Satisfied clients become active referral sources. A unified experience ensures every client interaction reinforces the firm's value proposition.

Operational Efficiency

Integrating siloed CRM, portfolio, and planning data gives wealth managers a unified 360° client view. This eliminates duplicate work and reduces errors.

Advisors spend less time searching for client information. More time becomes available for revenue-generating activities.

Revenue Growth

|

Impact Area |

Business Benefit |

|

Client Retention |

Reduced churn rates |

|

Cross-selling |

Higher revenue per client |

|

Referrals |

Lower acquisition costs |

|

Efficiency |

Increased advisor capacity |

Competitive Positioning

The quality of the advisor-client relationship increases in a holistic wealth-management business model. Firms differentiate themselves through superior service delivery.

A unified experience becomes harder for competitors to replicate. This creates sustainable market advantages.

The Future Of Wealth Management Is A Connected Advisor Client Experience

The wealth management industry is undergoing a fundamental transformation. Digital revolution is rapidly changing client expectations, forcing firms to adopt more connected approaches to serve their clients effectively.

Technology Integration drives the modern advisor-client relationship. Technology is changing the client experience by offering solutions to simplify processes and save time. Successful advisors recognize digital tools as essential for creating superior client experiences.

Connected experiences require seamless data flow between systems. The 2025 Connected Wealth Report highlights increasing dissatisfaction with outdated systems, emphasizing urgent needs for innovation in data integrity and system integration.

Key Connected Experience Elements:

- Real-time portfolio access across all devices

- Integrated communication platforms

- Automated reporting and alerts

- Self-service client portals

- Mobile-first functionality

More and more clients expect hyper-personalization and seamless availability of information. They demand the same technology-driven experiences they receive in other aspects of their digital lives.

M&A is reshaping wealth management through advanced technology and personalized care. Leading firms preserve the advisor's personal touch while leveraging tools that enhance the entire client journey.

The future holds a blend of people and technology delivering wholly personalized advice. Wealth management firms must create seamless connections between advisors, clients, and technology platforms.

Ready to Transform Your Advisor Client Experience?

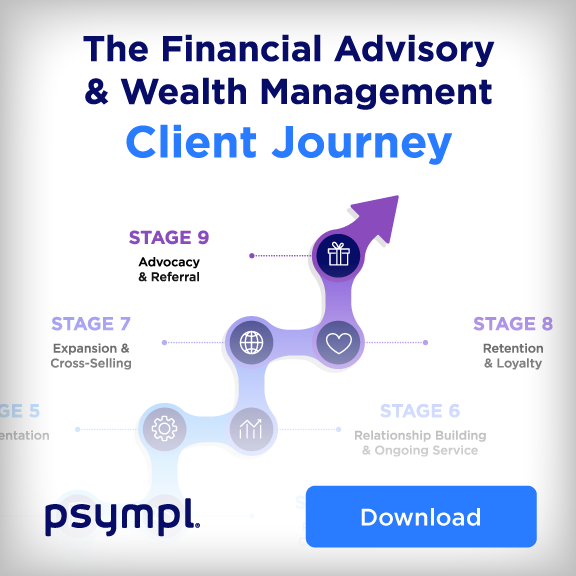

Download Psympl’s Client Journey for Wealth Management Infographic to see exactly how client motivations, psychographics, and channel behaviors intersect across every stage of the journey. Use it to build a more connected, personalized, and profitable experience across your advisor-led and digital channels.

Brent Walker

Co-Founder & Chief Strategy Officer

.svg)